Yesterday, European Central Bank (ECB) has started its much awaited monthly purchase programme of € 60 billion.

- Market participants say activities were seen in German, France and Belgium bonds yesterday.

- ECB has started off despite criticism that it could lose money holding the bonds till maturity.

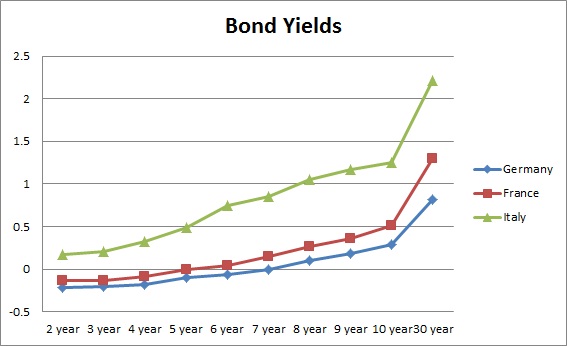

- QE eligible bonds in Germany, France, Netherlands, Finland, Austria, Belgium and Slovakia are trading in negative territory.

- As per the latest estimate, ECB will be buying € 850 billion worth of Euro zone government debt.

- German 10 year benchmark fell further 8 basis points yesterday to 0.31% sending the yield differential between US and Germany to record low.

- All Euro zone govt. bonds have benefited since the announcement except for Greece where the 10 year is still yielding close to 10%. Greek and Cyprus bonds are not eligible for purchase right now.

- ECB's bazooka is much smaller than that of US but supply issue is squeezing the bond market.

- Moreover ECB would need to buy in the secondary market to avoid monetary financing this further increases the cost for ECB as investors are to ask for premium for selling.

Euro which is already feeling downside pressure since last Thursday may fall further. Volatilities are expected to rise further in recent fall. Euro is currently trading at 1.075 against dollar.

Yields have fallen further in today's trading. German bunds are now negative yielding up to seven years and 10 year benchmark has fallen to 0.288%.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?