The ECB is expected to step up its easing by year-end to revive the recent sharp drop in inflation expectations. It is expected to extend its time-based commitment to QE for 6-9 months. EURUSD is likely to depreciate both in response to the decline in relative rates and the refocusing of market attention on the chasm between euro area and US growth prospects.

"We see a low probability of further cuts in the depo rate, which will have the greatest impact on the EUR", says Barclays.

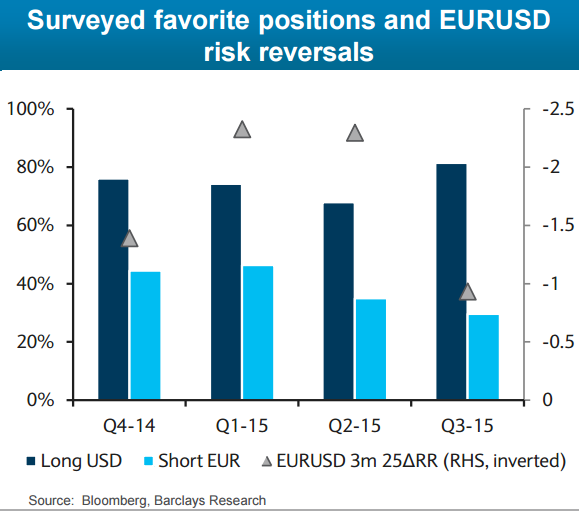

Positioning should not be a great impediment like in H1 2015, implied by a series of indicators including risk reversals which suggest a collapse in USD skew.

ECB the catalyst for a renewed push lower in the EUR

Thursday, September 24, 2015 11:12 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX