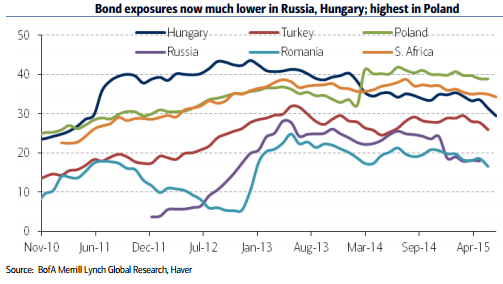

Foreign bond holders in local debt markets of EEMEA have significantly reduced their ownership shares in most countries. The most significant drops are in Hungary (from a high of more than 40% ownership to below 30% now) and Russia (from near 30% to about 18% now). In most markets, the decline began in 2012 or 2013. The one exception is Poland, where about 40% of the domestic market is still owned by foreigners. There has been very little decline in ownership after the boost caused by the pension industry changes in 2013-14. Investment-grade mandate holders {including sovereign wealth funds (SWF) and central banks}, traditionally western Europe sovereign investors or simply sanguine dedicated EM investors looking at Euro entry in the distant future likely explains this sticky vote of confidence in Poland.

"If the Fed rhetoric and behaviour is surprisingly hawkish compared to current market pricing, we see scope for further reductions from EEMEA. And this could put pressure on Poland as well, in our view. That said, most markets now seem to be anticipating the Fed to take a relatively gradual path," notes BofA Merrill Lynch.

EEMEA: Foreign bond holders are less dominant now

Thursday, August 6, 2015 9:12 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022