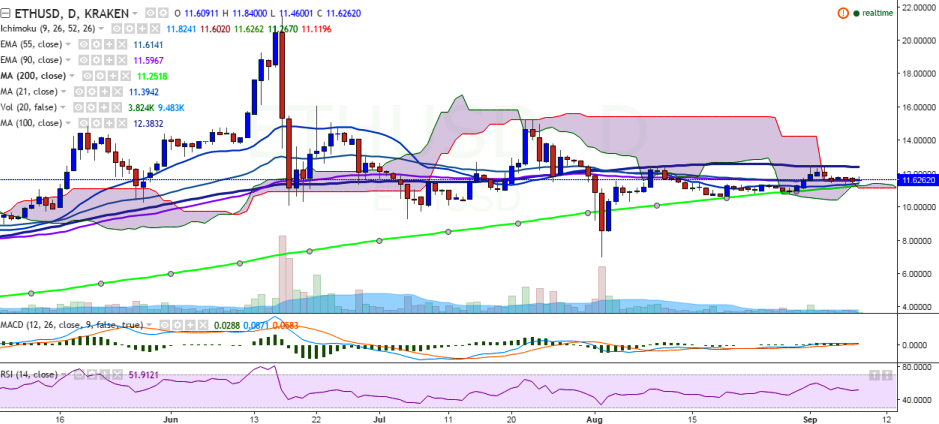

ETH/USD has considerably weakened in the past couple of days after hitting 12.54 levels. The pair has slipped below 90 EMA and is currently trading at 11.46 levels, at the time of writing (Kraken).

Ichimoku analysis of daily chart:

Tenkan Sen: 11.75

Kijun Sen: 11.60

Trend reversal: 11.59 (90 EMA)

“The has broken below 90 EMA and is trading in the red. Short-term trend appears weak for the pair and a close below 200-day MA would confirm further bearishness”, FxWirePro said in a statement.

On the top side, major resistance is seen at 12.40 (100-day MA) and a break above would target 13.47 (78.6% retracement of 15.23 and 7.00)/15.23 (July 22 high).

On the other hand, support is likely to be found at 11.21 (200-day MA) and a close below would see the pair falling to 10.00 (psychological level) and then to 9.77(50% retracement of 7 and 12.54).

ETH/USD trades weak, break below 200-day MA confirms further bearishness

Thursday, September 8, 2016 10:57 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary