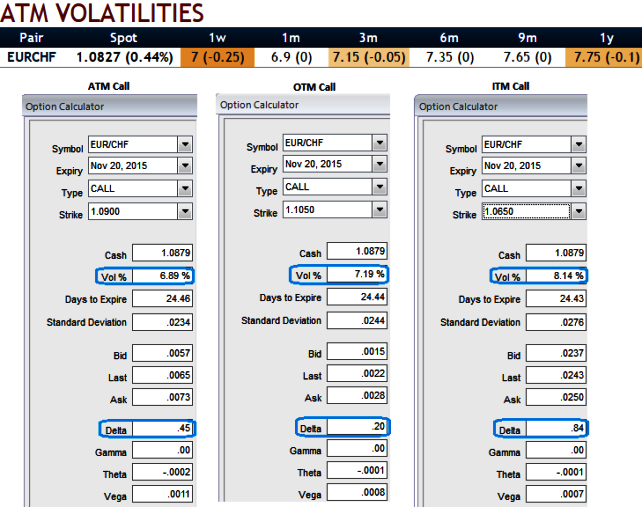

In a true smile, options with an at-the-money strike are priced with a lower volatility than out-of-the-money and in-the-money volatility strikes. Such market occurrences are observable in the EURCHF FX OTC market.

For instance, suppose we've constructed an at the money call option of EURCHF with this month expiry and with this given maturity has an implied volatility of 7% (6.89% to be precise, and that its delta amounts close to 50%.

We ponder now with an another call option with the same maturity on the same pair is priced with an implied volatility of 7.15% but its strike is 2% out of the money (strike at 1.1050) and while its delta is just shy of 20%.

Furthermore, let's contemplate a 3rd option with a strike in the money strike and a delta of 80% is also priced with a volatility of 8%.

On a 1-3m horizon, our target for this pair is still higher though we have adjusted our Q4 forecast (at 1.10) but certainly not with steep moves. Fundamentally, the latest quarterly SNB meeting also did nothing to change the currency outlook.

The inflation forecast was revised lower again in the near-term (on lower energy prices) though the long-term forecast was little changed.

Although EUR/CHF reached a new post-floor high in the beginning September (at 1.1049), the pace of appreciation is painfully slow, Infact the fluctuation has been softened.

We have positioned for higher EUR/CHF in options with a risk reversal but the long tenor (1y at entry, expiring July 2016) shows how long we expect this process to take.

EUR/CHF creeps up with snail’s pace - volatility smiles suggest ATM instruments

Tuesday, October 27, 2015 1:57 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro: USD/ZAR edges higher but bearish outlook persists

FxWirePro: USD/ZAR edges higher but bearish outlook persists  FxWirePro: GBP/NZD downtrend loses steam but outlook still bearish

FxWirePro: GBP/NZD downtrend loses steam but outlook still bearish  Bitcoin Stuck in $66K–$67K Cage – Break $70K and $78K+ Becomes the Prize

Bitcoin Stuck in $66K–$67K Cage – Break $70K and $78K+ Becomes the Prize  FxWirePro: GBP/AUD key support held, downside risk remains

FxWirePro: GBP/AUD key support held, downside risk remains  FxWirePro- Major Pair levels and bias summary

FxWirePro- Major Pair levels and bias summary  FxWirePro: EUR/NZD recovers slightly but bears are not done yet

FxWirePro: EUR/NZD recovers slightly but bears are not done yet  FxWirePro: AUD/ USD edges up as Australian dollar gains on hawkish RBA outlook

FxWirePro: AUD/ USD edges up as Australian dollar gains on hawkish RBA outlook  ETH Follows BTC Higher: $2056 and Climbing – Bulls Locked In Above $2000

ETH Follows BTC Higher: $2056 and Climbing – Bulls Locked In Above $2000  FxWirePro: GBP/AUD extends drop, vulnerable to more downside

FxWirePro: GBP/AUD extends drop, vulnerable to more downside  FxWirePro: USD/CAD steadies around 1.3680,retains bid tone

FxWirePro: USD/CAD steadies around 1.3680,retains bid tone  Pound Sell-Off Accelerates: GBP/JPY Drops to 209.93, Eyes Major Support Zone

Pound Sell-Off Accelerates: GBP/JPY Drops to 209.93, Eyes Major Support Zone  FxWirePro: GBP/USD slides as UK political uncertainty weighs on pound

FxWirePro: GBP/USD slides as UK political uncertainty weighs on pound  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro: USD/CAD changes short term trend from neutral to bearish

FxWirePro: USD/CAD changes short term trend from neutral to bearish  FxWirePro:EUR/AUD upside limited, scope for a dve through a key fibo

FxWirePro:EUR/AUD upside limited, scope for a dve through a key fibo