EURJPY showed a minor sell-off after forming a temporary top around 175.05 due to yen strength. It hits an intraday low of 174.20 and is currently trading at approximately 174.211. Intraday outlook remains bullish as long as support 173 holds.

Technical Analysis:

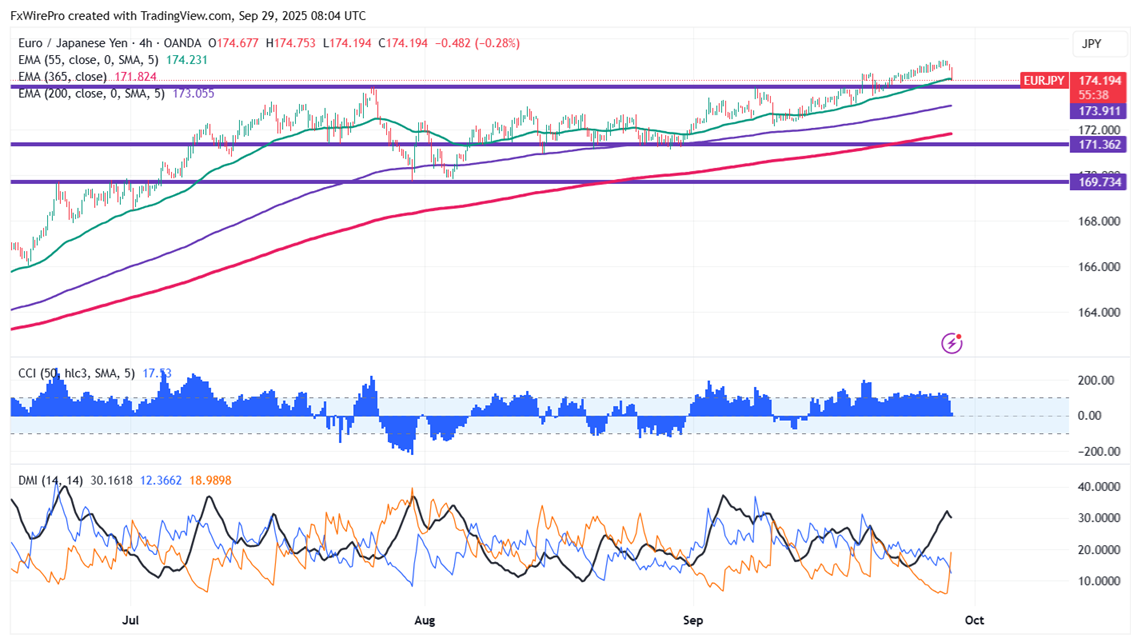

The EUR/JPY pair is trading above 55 EMA, 200, and 365-H EMA on the 4-hour chart.

- Near-Term Resistance: Around 175, a breakout here could lead to targets at 176/176.80.

- Immediate Support: At 173.78 if breached, the pair could fall to 173.45/173/172.50-/171.80/170.80/169.70/169/168.70/168.45/168.

Indicator Analysis 4-hour chart): - CCI (50): Bullish

- Average Directional Movement Index: Neutral

Overall, the indicators suggest a Bullish trend

Trading Recommendation:

It is good to buy on dips around 173.78-80 with a stop loss at 173 for a TP of 176.