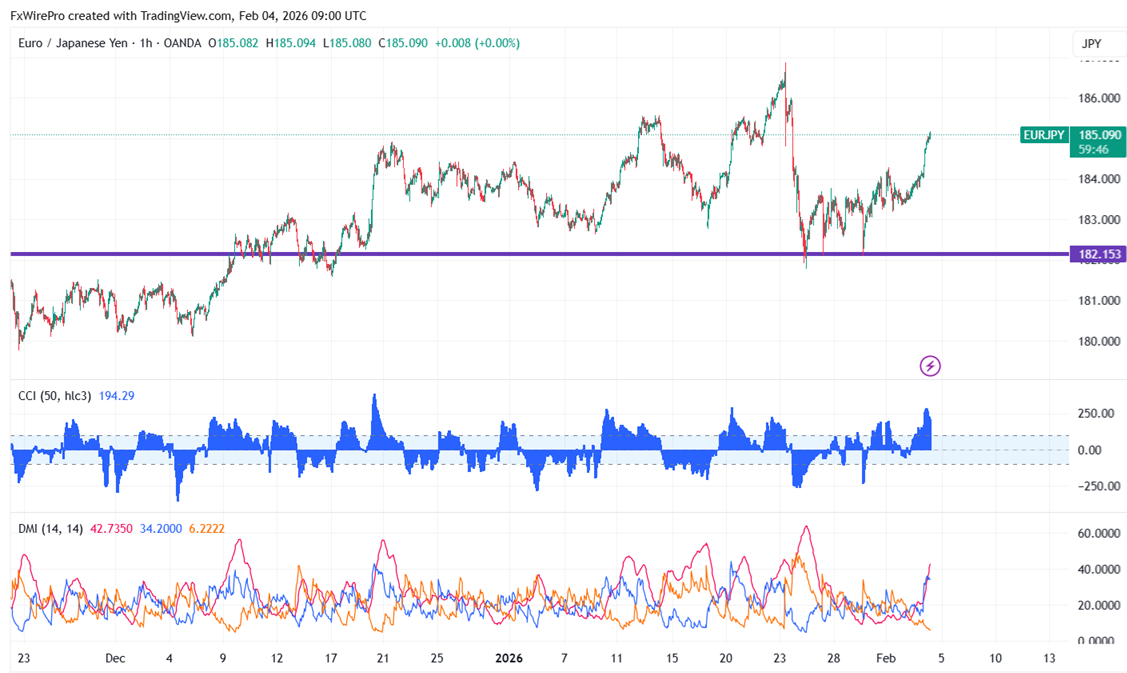

EURJPY moves higher for the second straight day following creation of a small bottom at roughly 181.78. The trend for now is bullish as long as it stays above 183. After reaching an intraday high of 185.16, it presently sits at around 185.10.

Technical Analysis:

The EUR/JPY pair is trading above 55 EMA, 200, and 365-H EMA on the 4-hour chart.

- Near-Term Resistance: Around 185.67,a breakout here could lead to targets at 186.29/187/188.69.

- Immediate Support: At 183.80, if breached, the pair could fall to 183/182/181.75/180.

Indicator Analysis (1- hour chart): - CCI (50): Bullish

- Average Directional Movement Index: Bullish

Overall, the indicators suggest a bullish trend

Trading Recommendation:

It is good to buy on dips around 183.78-80 with a stop loss at 183 for a TP of 187.

FxWirePro: GBP/NZD remains weak, eyes 2.2550 level

FxWirePro: GBP/NZD remains weak, eyes 2.2550 level  FxWirePro: NZD/USD slips as New Zealand’s unemployment rises in Q4

FxWirePro: NZD/USD slips as New Zealand’s unemployment rises in Q4  Iran Unrest Sparks Oil Rally — Bounce Off EMA, Buy Dips to $66.40 Glory

Iran Unrest Sparks Oil Rally — Bounce Off EMA, Buy Dips to $66.40 Glory  FxWirePro: GBP/NZD outlook weaker on renewed downside pressure

FxWirePro: GBP/NZD outlook weaker on renewed downside pressure  FxWirePro: GBP/USD regains upwards momentum but unable to hold above 1.3700 level

FxWirePro: GBP/USD regains upwards momentum but unable to hold above 1.3700 level  FxWirePro: USD/ZAR dips below lower range, bearish bias increases

FxWirePro: USD/ZAR dips below lower range, bearish bias increases  FxWirePro- Major European Indices

FxWirePro- Major European Indices  FxWirePro-Major European Indices

FxWirePro-Major European Indices  FxWirePro- Major Pair levels and bias summary

FxWirePro- Major Pair levels and bias summary  FxWirePro: GBP/AUD extends losses after RBA rate hike

FxWirePro: GBP/AUD extends losses after RBA rate hike  USD/CHF Pauses After 200-Pip Rally — Buy Dips Near 0.775, Target 0.790

USD/CHF Pauses After 200-Pip Rally — Buy Dips Near 0.775, Target 0.790  AUDJPY Smashes 30-Month Peak — Buy the Dip, 112 in Sight

AUDJPY Smashes 30-Month Peak — Buy the Dip, 112 in Sight  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  FxWirePro: USD/CAD attracts selling interest, vulnerable to more downside

FxWirePro: USD/CAD attracts selling interest, vulnerable to more downside  FxWirePro: AUD/USD remains buoyant, looks to extend gains

FxWirePro: AUD/USD remains buoyant, looks to extend gains