EURJPY gained sharply after upbeat Eurozone economic data. It hits an intraday high of 173.656 and is currently trading at approximately 173.624. Intraday outlook remains bullish as long as support at 172.50 holds.

With a rise from 34.7 in August to 37.3 points in September 2025, Germany's ZEW Economic Sentiment Index unexpectedly soared well beyond predictions of 26.3, indicating a cautious stability in forward-looking optimism following a sudden decline from 52.7 peak in July, especially supported by gains in export industries despite recent declines. The ZEW Current Situation Index, however, fell to-- -76.4 from -68.6, surpassing predictions of -75.0 and highlighting worsening current economic problems. Among a poll of 180 financial experts indicating mid-term expectations, President Achim Wambach of ZEW noted continuing risks from U.S. tariff uncertainties and Germany's ongoing reforms. on a scale from -100 to +100. As the only G7 economy stagnant for two years, Germany battled a 0.1% Q2 contraction caused by declining U.S. demand pre-tariffs and structural obstacles, promoting downward revisions to 2025 growth forecasts despite hopes for Chancellor Friedrich Merz's government to spur revival.

Technical Analysis:

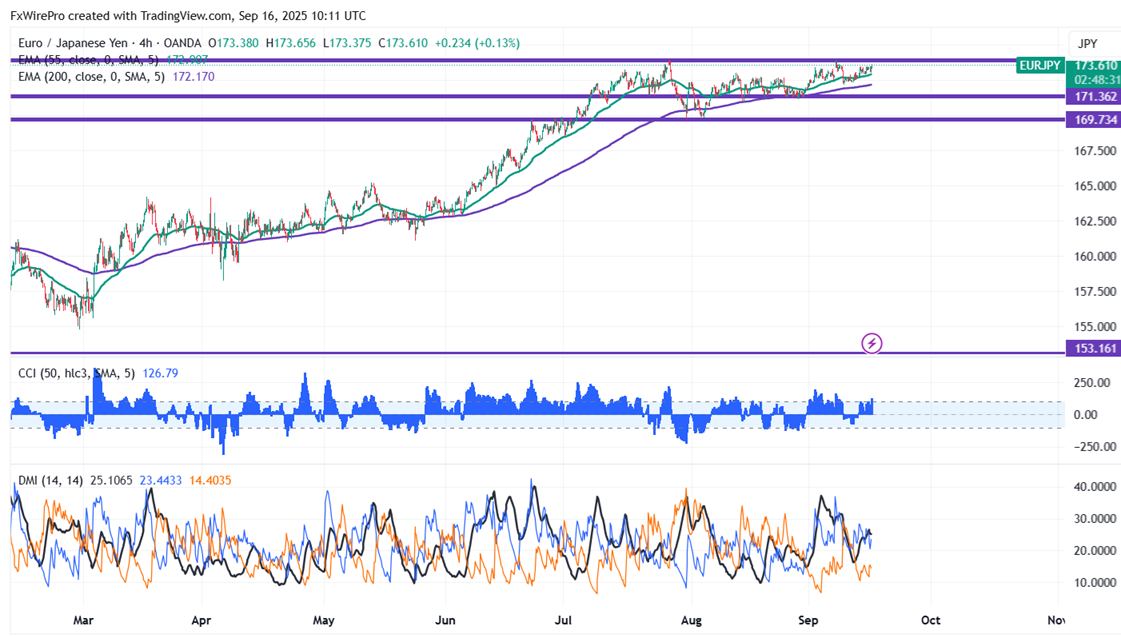

The EUR/JPY pair is trading above 55 EMA, above 200, and 365-H EMA on the 4-hour chart.

- Near-Term Resistance: Around 174, a breakout here could lead to targets at 174.38/175/176.

- Immediate Support: At 173, if breached, the pair could fall to 172.50-/171.80/170.80/169.70/169/168.70/168.45/168.

Indicator Analysis 4-hour chart): - CCI (50): Bullish

- Average Directional Movement Index: Neutral

Overall, the indicators suggest a mixed trend

Trading Recommendation:

It is good to buy on dips around 172.68-70 with a stop loss at 172 for a TP of 175.