Before heading towards further, let’s just glance through our analysis in our previous write-up on this pair. Please follow the below weblink:

Well, we explicitly stated mounting bearish sentiments in this article, ever since this posting, we’ve seen almost more than 150 pips of price dips. Rest is history.

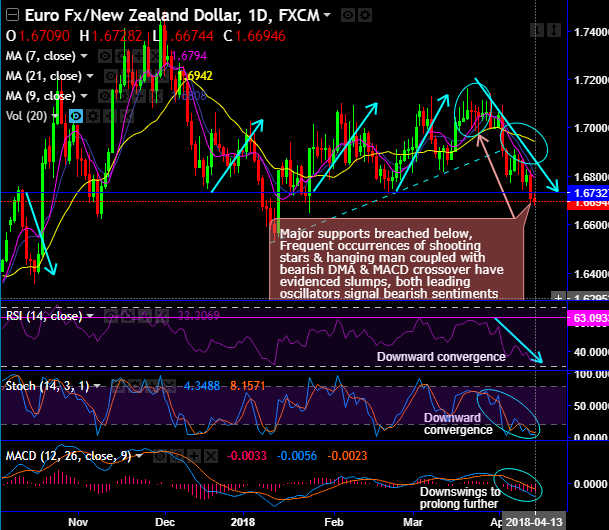

For now, EURNZD has exposed a decisive breach below major rising channel (on weekly) and trend-line support (on daily terms), intraday bias lower.

Price action currently hovers well below DMAs and EMAs at 1.6685 (on daily and weekly respectively).

Yesterday, it has managed to be broken the storng support at 1.6732 levels. The violation below is extending the weakness of this pair.

On a broader perspective, amid bearish traction, the major trend has been stuck in range (refer rectangular area on weekly chart).

Next major bearish target lies at 1.6621 levels that is where next immediate strong supports are observed. Any violation there would foresee further downside tractions upto 1.6525 levels.

On the flipside, 1.6732 and 1.6792 (i.e.7DMA) levels are considered as the major resistance, we see bearish invalidation only upon break-out above these levels in near terms.

Support levels - 1.6621, 1.6525 (Jan 11 low)

Resistance levels - 1.6732 and 1.6792 (7MA).

On intraday trading grounds one can one touch binary put options which likely to fetch exponential yields as underlying spot FX keeps dipping. Since overall bias remains lower, staying short in futures of mid-month tenors with a view to arresting further downside risks would be a wise idea.

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -73 levels (which is bearish), while hourly NZD spot index was at 18 (neutral) while articulating at 11:14 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit: