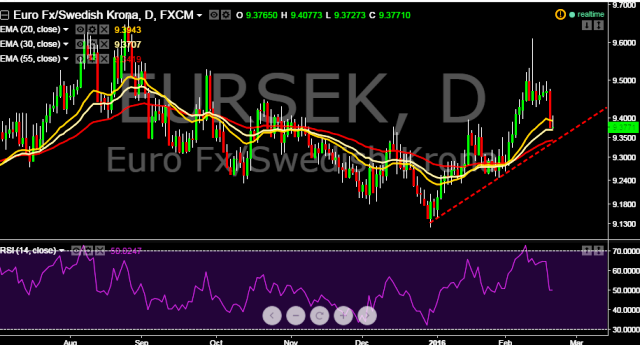

Pair is currently supported above 9.38 levels and trading at 9.3811 marks.

- It made intraday high at 9.4077 and low at 9.3727 levels.

- From the data front from Sweden, Country released its job data.

- Swedish unemployment rose to 7.5 percent in January, above the 6.7 percent in the previous month.

- In addition, total employment stood at 4.791 million people, down from 4.821 million people the previous month. Seasonally adjusted, the unemployment rate was 7.0 percent, down from 7.2 percent in the previous month.

- Intraday bias remains neutral for the moment.

- A daily close above 9.3971 will turn the bias bullish.

- Alternatively, recent downfall will take the parity towards key support levels at 9.3517 and 9.3263 thereafter.

We prefer to take long position on EUR/SEK around 9.3750, stop loss 9.3517 and target 9.4123 levels.