EUR/USD trades flat ahead of US Fed monetary policy. It hit an intraday high of 1.13779 and currently trading around 1.13693.

The Federal Reserve is most likely to leave interest rates unchanged at 4.25%-4.5% at today's meeting, with a 2 p.m. EST announcement followed by a press conference featuring Chairman Jerome Powell. This move occurs in the face of mixed signals from the economy, such as a negative Q1 GDP, strong job growth, and the inflationary effects of President Trump's tariffs. Market sentiment heavily expects this hold, in addition to awaiting possible rate reductions later in the year, beginning in July or September, subject to economic conditions. Investors will be keenly listening to Powell's remarks regarding the timing of subsequent rate cuts, as the Fed balances the issues of tariff-induced inflation and decelerating economic growth, taking a "wait-and-see" approach.

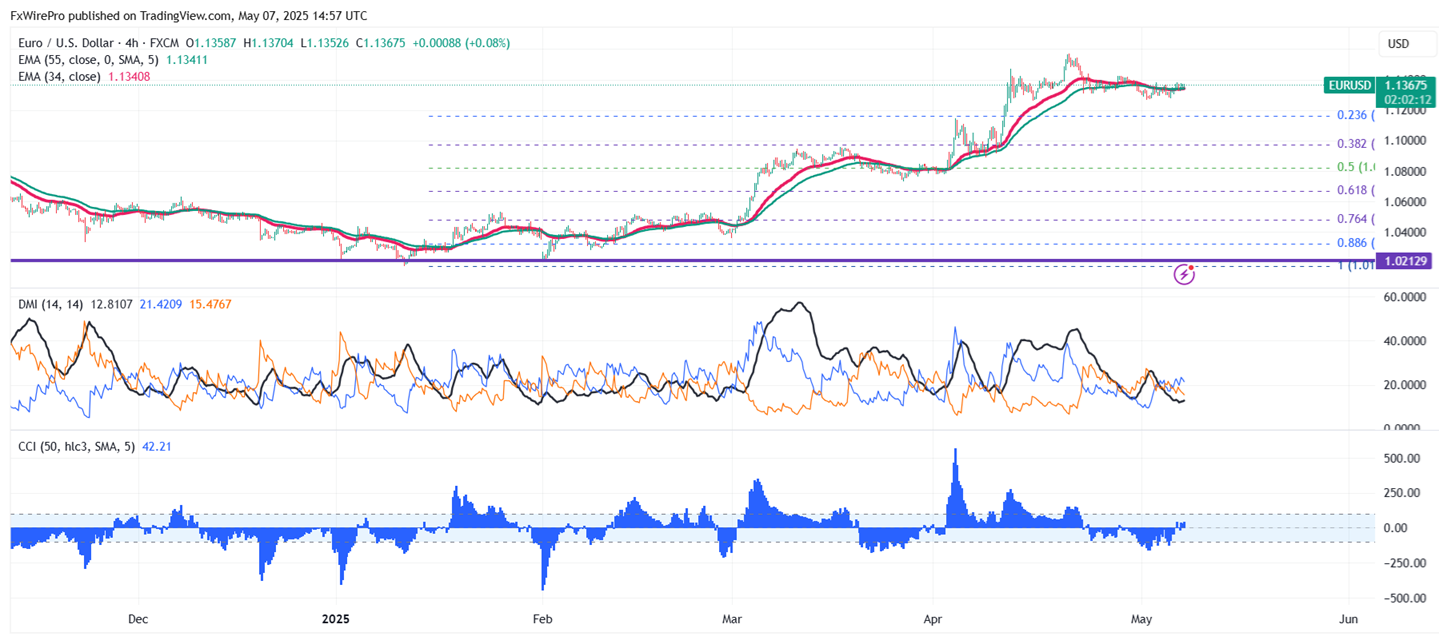

Technical Analysis of EUR/USD

The pair is holding below above short and long-term moving averages in the 4-hour chart. Near-term resistance is seen at 1.1380; a break above this may push the pair to targets of 1.1425/1.1450/1.1500/ 1.1570/1.1600. Major bullish momentum is likely only if prices are able to break above the 1.160 target of 1.1660. On the downside, support is seen at 1.13000 any violation below will drag the pair to 1.1265/1.1240/1.1150/1.11000/1.10840/1.1000.

Market Indicators and Trading Strategy

Commodity Channel Index (CCI)- Bullish

Average Directional Movement Index (ADX) - Bullish

It is good to buy on dips around 1.1340-25 with a stop-loss at 1.1300 for a target price of 1.1500.