EURUSD lost its shine after upbeat US retail sales data.It hits a high of 1.05923 at the time of writing and is currently trading around 1.05555.

Today, the U.S. Census Bureau announced that retail sales in October 2024 rose by 0.4% compared to September, exceeding the expected increase of 0.3%. September's sales numbers were also revised upward to show a 0.8% gain, up from 0.4%. In total, October's retail sales reached about $714.4 billion. However, when excluding automotive and fuel sales, the increase was just 0.1%, which was below the predicted 0.3%. The control group data, important for GDP calculations, showed a decrease of 0.1%, contrasting with expectations of a 0.3% increase.

Technical Analysis Overview

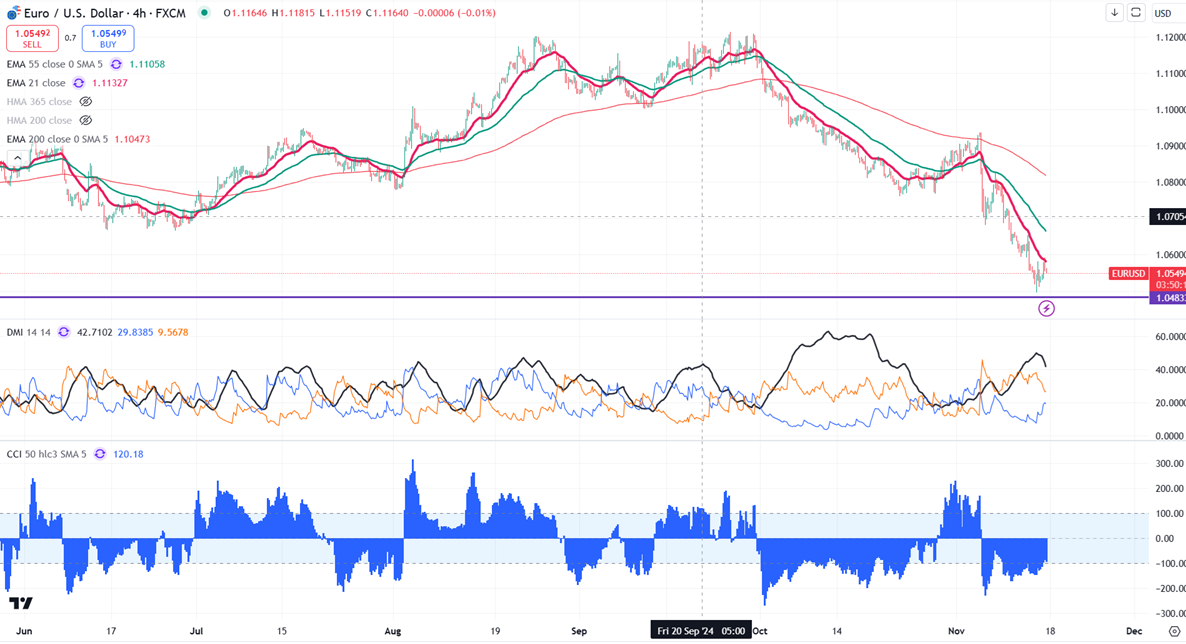

The pair remained below both short-term (34 and 55-4H EMA) and long-term (200-4H MA) moving averages.

Resistance Levels: Near-term resistance is at 1.0580. A breakout above this could push the pair towards targets at 1.0600/1.0660/1.070/1.0760/$1.0835, and possibly 1.0900. Major bullish momentum is expected only if prices surpass 1.1000, which would open the door to 1.1070 and 1.1150.

Support Levels: Immediate support is at 1.0500. A drop below this could lead to further declines to 1.0435/ 1.0400.

Indicator Insights (4-Hour Chart): The Commodity Channel Index (CCI) indicates a bearish trend, while the Average Directional Movement Index (ADX) suggests a bearish outlook.

Trading Strategy

Given the weak sentiment in technical indicators, a sensible strategy would be to sell on rallies around the 1.0600 mark, with a stop-loss at 1.0660 and a target price of 1.0435 for potential gains.