EUR/USD has traded in a wide range over the past month, briefly hitting a sixmonth high above 1.17 in mid-late August following China's currency devaluation. The ramifications of this devaluation, especially on US monetary policy, dominated EUR/USD sentiment. Although the currency pair has since fallen back from its August highs, the FOMC decision to leave its key policy rate unchanged at its 16/17 September policy meeting has put the US dollar back on the defensive. Given the weakness of commodity prices and the euro area's export exposure to China, the ECB has also sounded a dovish note.

Looking ahead, how the competing forces of US and European monetary policy break for EUR/USD remains uncertain. Much will depend on the timing and extent of the slowdown across Asia. China's downturn will not prove as aggressive as currently feared, paving the way for a rise in US interest rates in December or early 2016.

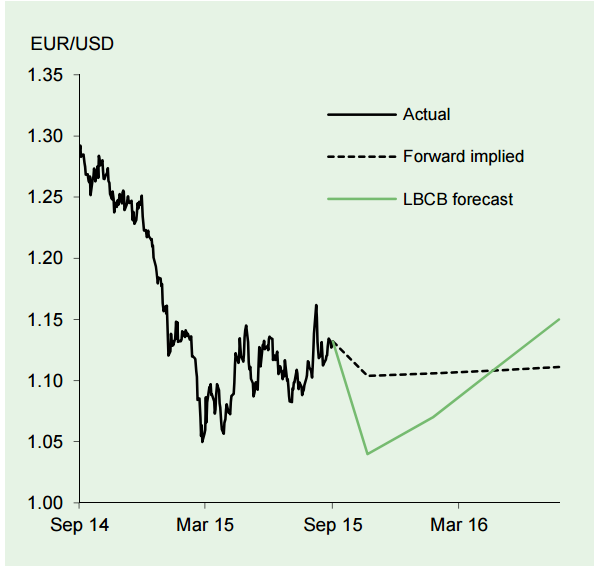

"We retain our view that EUR/USD will fall below 1.10 by year end. Thereafter, a broader euro area recovery and only a very gradual US policy tightening should lay the ground for more sustained EUR strength. We target 1.07 by year end and 1.17 by end 2016", notes Lloyds Bank.

EUR/USD Outlook

Wednesday, September 23, 2015 10:16 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed