EUR/USD pared some of its gains after strong US jobs data. It hits a low of 1.17165 and is currently trading around 1.17831. Overall trend remains bullish as long as support 1.1700 holds.

The June 2025 U.S. Non-Farm Payrolls report demonstrated notable strength in the labor market, with 147,000 jobs added, substantially surpassing the consensus estimate of 110,000. The unemployment rate declined to 4.1%, compared to May’s 4.2%. Although wage growth remained somewhat muted—average hourly earnings increased by 0.2% month-over-month and 3.7% year-over-year, both slightly below expectations—the data overall reflects a resilient employment landscape. The combination of robust job creation and a modest decline in unemployment suggests ongoing stability in the labor sector, even as subtle indicators point to a gradual moderation in wage growth.

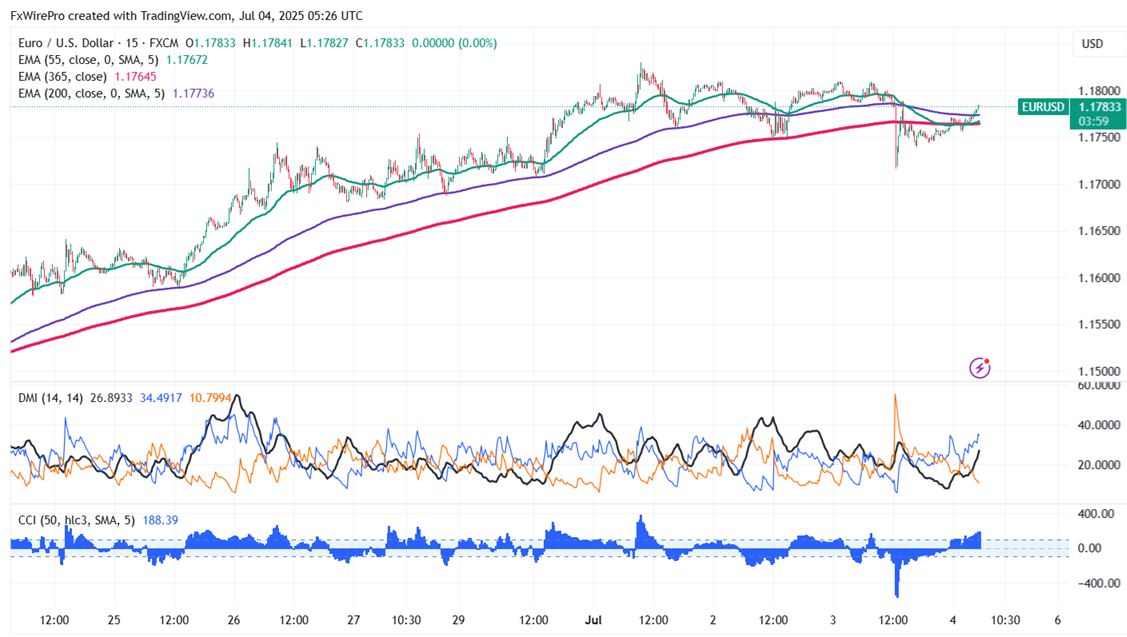

The pair is holding above the 55 EMA,200 EMA, and below the 365 EMA in the 15-minute chart. Near-term resistance is seen at 1.1800; a break above this may push the pair to targets of 1.1835/1.19090/1.1956/1.200. Major bullish momentum is likely only if prices can break above the 1.200 target and 1.2100. On the downside, support is seen at 1.1760 (365 15 min EMA), any violation below will drag the pair to 1.17400/1.1700/1.1660/1.1600.

Market Indicators and Trading Strategy

Commodity Channel Index (CCI)- Bullish

Average Directional Movement Index (ADX) - Bullish

It is good to buy on dips around 1.1778-80 with a stop-loss at 1.750 for a target price of 1.1835/1.1900.