EUR/USD pared most of its gains after strong jobs data. It hits a intraday high of 1.13547 and currently trading around 1.13149.

The US April 2025 Non-Farm Employment Change registered a gain of 177,000 jobs, which was better than the 130,000-145,000 consensus, although lower than the revised March figure of 185,000. The unemployment rate remained at 4.2%, while average hourly pay increased 0.3% month-on-month. This better-than-expected growth in jobs alleviates near-term pressure on the Federal Reserve to lower rates next month, even though the labor market indicates signs of decelerating relative to last year.

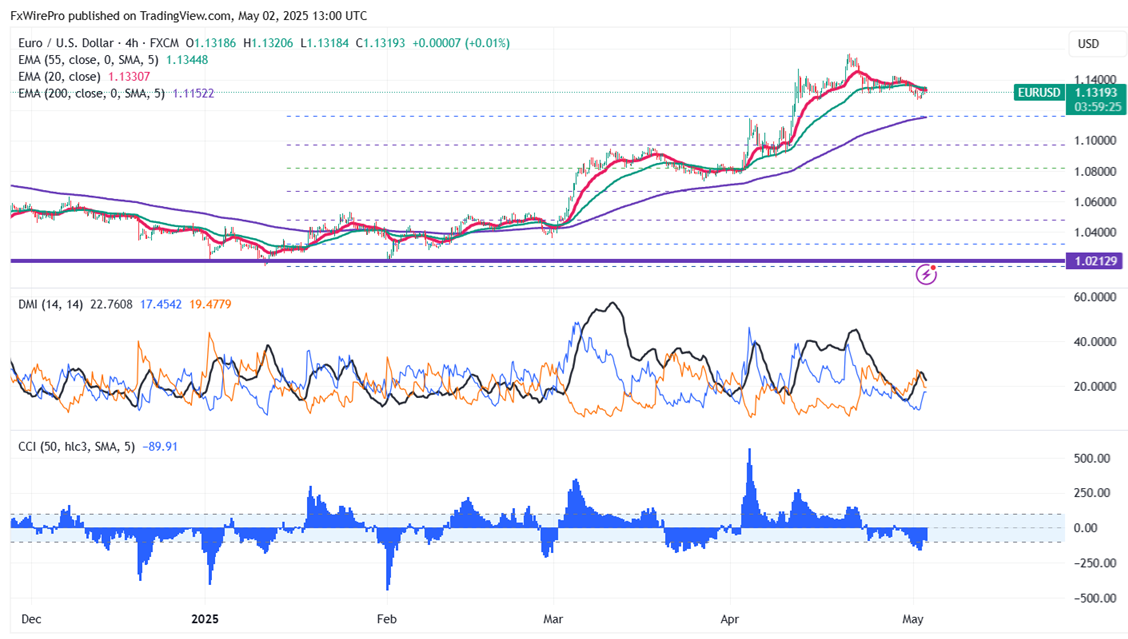

Technical Analysis of EUR/USD

The pair is holding below above short and long-term moving averages in the 4-hour chart. Near-term resistance is seen at 1.1360; a break above this may push the pair to targets of 1.1380/1.1425/1.1450/1.1500/ 1.1570/1.1600. Major bullish momentum is likely only if prices can break above the 1.160 target of 1.1660. On the downside, support is seen at 1.1265 any violation below will drag the pair to 1.1240/1.1150/1.11000/1.10840/1.1000.

Market Indicators and Trading Strategy

Commodity Channel Index (CCI)- Bearish

Average Directional Movement Index (ADX) - Neutral

It is good to sell on rallies around 1.1348-50 with a stop-loss at 1.140 for a target price of 1.1200.