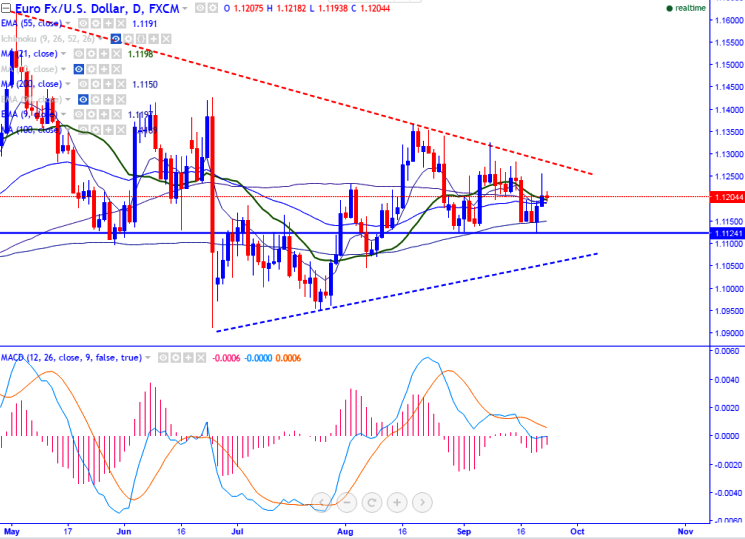

- EUR/USD showed huge jump from the low of 1.11229 after Fed monetary policy. But not able to hold above 1.1200 level.

- The pair has broken major psychological level at 1.1200 and declined till 1.1938 at the time of writing. On the lower side, support stands at 1.119 (55- day EMA)/1.1149 (200- day MA)/1.1120 (Sep 21st low).

- Short term weakness below 1.1120 level.

- The major resistance is around 1.12930 (trend line joining 1.16163 and 1.13663) and any break above targets 1.13660.The minor resistance is around 1.1245 (daily Kijun-Sen).

It is good to buy at dips around 1.1195 with SL around 1.1145 for the TP of 1.1290/1.1360.