EUR/USD trades weak despite diminishing rate cut hopes. It hits an intraday low of 1.16066 and is currently trading around 1.16157. Intraday trend remains bearish as long as resistance holds.

ECB President Christine Lagarde emphasized the central bank's strong monetary policy stance in her October 21, 2025 speech at 11 AM GMT amidst a strong Supported by strong home demand, steady labor markets, and slowing wage growth, the eurozone economy with inflation stabilizing at the 2% medium-term target and disinflation completely reached. and lowering pressures from tariffs and global commerce uncertainty anticipated to relieve next year. Highlighting caution amid geopolitical tensions, she repeated the ECB's data-driven, meeting-by-meeting approach without pre-committing to rate paths and noted that a stronger euro could further control inflation as core pressures decrease as a result of reduced labor expenses. Slight decreases in euro bond yields were sparked by the remarks, which have caused traders to lower their expectations for additional ECB rate cuts, therefore showing the possibility. end of the easing cycle based on the present economic stability.

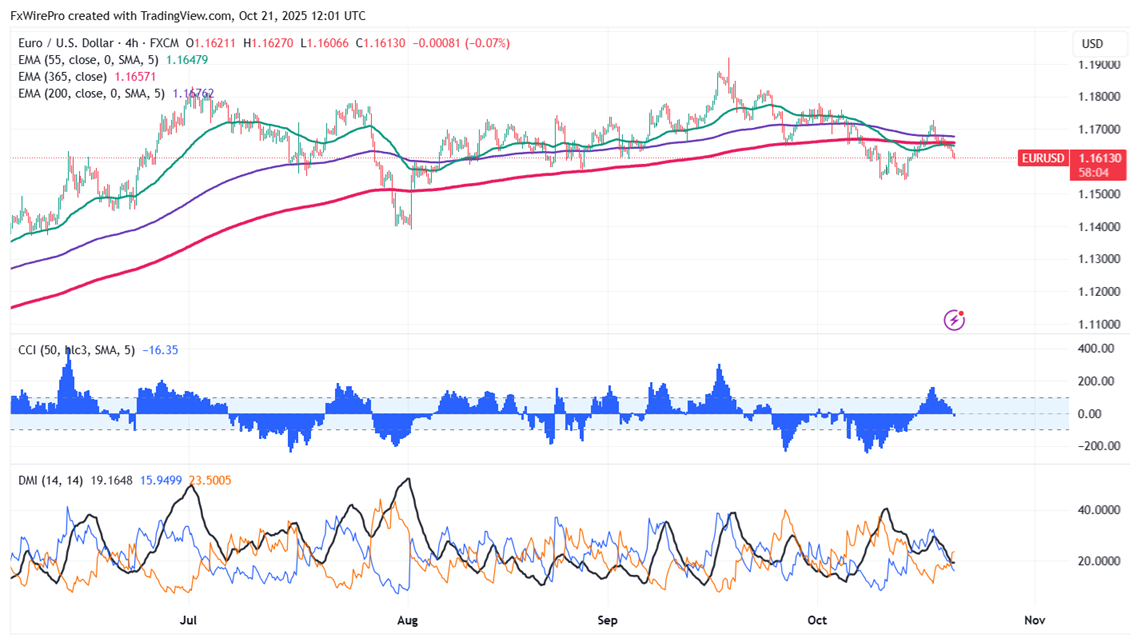

The pair is holding below the 55 EMA, 200 EMA, and 365 EMA in the 4-hour chart. Near-term resistance is seen at 1.1670; a break above this may push the pair to targets of 1.1700/1.1765/1800/1.1835/1.1850/1.1920. On the downside, support is seen at 1.1600; any violation below will drag the pair to 1.15750/1.1540/1.1480/1.1435.

Market Indicators and Trading Strategy

Commodity Channel Index (CCI)- Bearish

Average Directional Movement Index (ADX) - Bearish

It is good to sell on rallies around 1.1670 with a stop-loss at 1.1725 for a target price of 1.1575/1.1520.