EUR/USD gained sharply after dismal US CPI. It hits an intraday high of 1.12283 and is currently trading around 1.11882.

US March 2025 retail sales rose 1.4% from February, more than the expected 1.2% rise and marking the highest growth since January 2023. Most of this growth was achieved through a 5.3% rise in the sale of motor vehicles and auto parts due to consumers pre-buying ahead of tariff increases being expected. Without autos, retail sales still rose 0.5%, while core retail sales, excluding autos, gasoline, building materials, and food services, rose 1.0%, improving over the expected 0.2%. This data indicates strong consumer demand and a good retail sector in spite of economic uncertainty and tariffs.

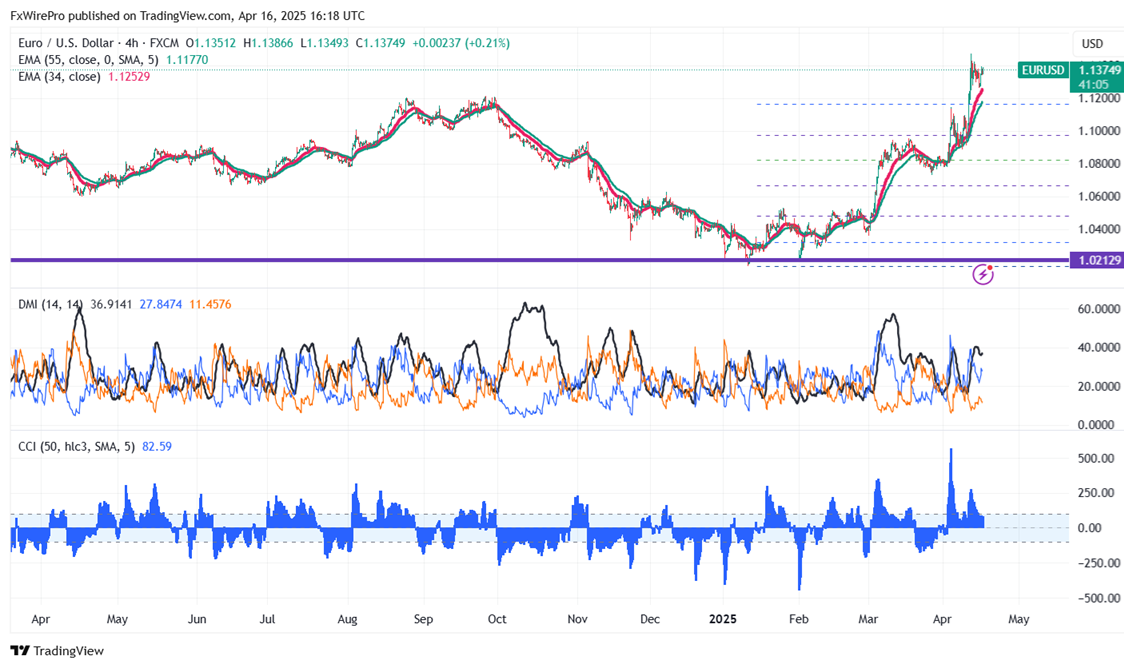

Technical Analysis of EUR/USD

The pair is holding above short and long term moving average in the 4-hour chart. Near-term resistance is seen at 1.1400; a break above this may push the pair to targets of 1.1450/1.1500. Major bullish momentum is likely only if prices are able to break above 1.150 targets 1.1600. On the downside, support is seen at 1.1330 any violation below will drag the pair to 1.1270/1.1240/1.1150/1.11000/1.10840/1.1000.

Market Indicators and Trading Strategy

Commodity Channel Index (CCI)- Bullish

Average Directional Movement Index (ADX) - Bullish

It is good to buy on dips around 1.1300 with a stop-loss at 1.1245 for a target price of 1.150.