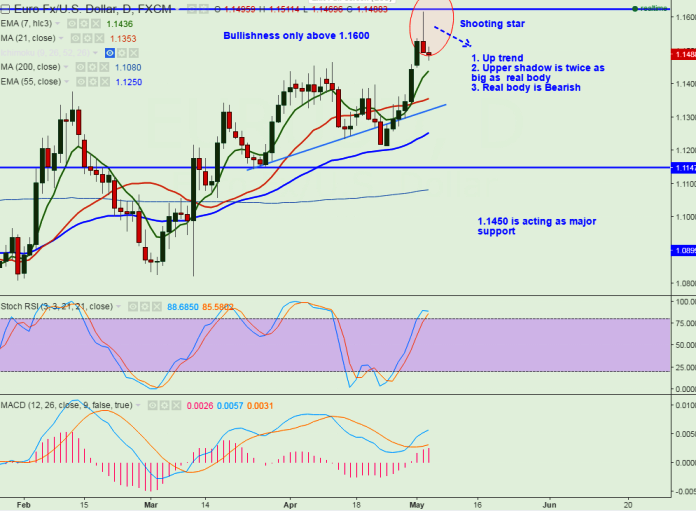

- Pattern Formed –Shooting Star

- Potential Reversal Zone – 1.1620

- The pair has retreated after making a high of 1.16161 yesterday. It is currently trading around 1.14890.

- Short term trend is slightly bearish as long as resistance 1.16200 holds.

- On the higher side minor resistance is around 1.1550 and any indicative break above 1.155 will take the pair to next level till 1.1600/1.16200.

- EUR/USD short term support is around 1.1450 and break below targets 1.1370/1.13300/1.12700.

It is good to sell on rallies around 1.1535-1.1540 with SL 1.1620 for the TP of 1.13700/1.1275.

R1-1.1550

R2-1.1600

R3-1.1620

Support

S1-1.1450

S2-1.1370

S3-1.1330