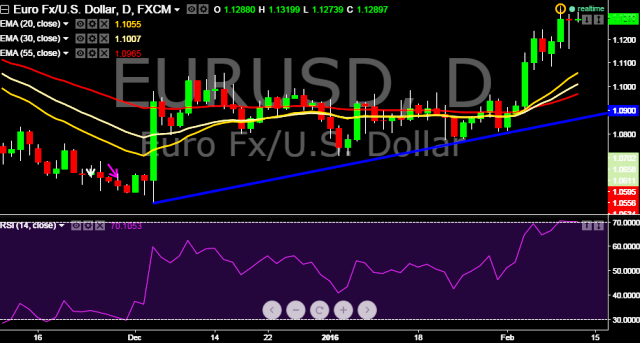

- Pair is currently trading at $1.1290 marks.

- It made intraday high at $1.1319 and low at $1.1273 levels.

- Intraday bias in EUR/USD remains positive.

- A daily close below $1.1050 will turn the bias again downside and next downside target will be $1.0809 levels.

- On the other side, initial resistance level is seen at $1.1362 levels and $1.15 thereafter.

- In data front from US, the US government delivered positive news after three months of continued deficits, posting a $55 billion budget surplus for the month of January.

- The main event for the day is Euro group meeting. Under such event, the Euro group coordinates economic policies of the 19 euro area member states. Their initiatives and decisions can have a widespread effect on the Euro zone's economic health.

- Fed chair Yellen will also have her second day of testimony to Congress later today.

We prefer to take long position in EUR/USD around $1.1280, Stop loss $1.1150 and target $1.15 marks.