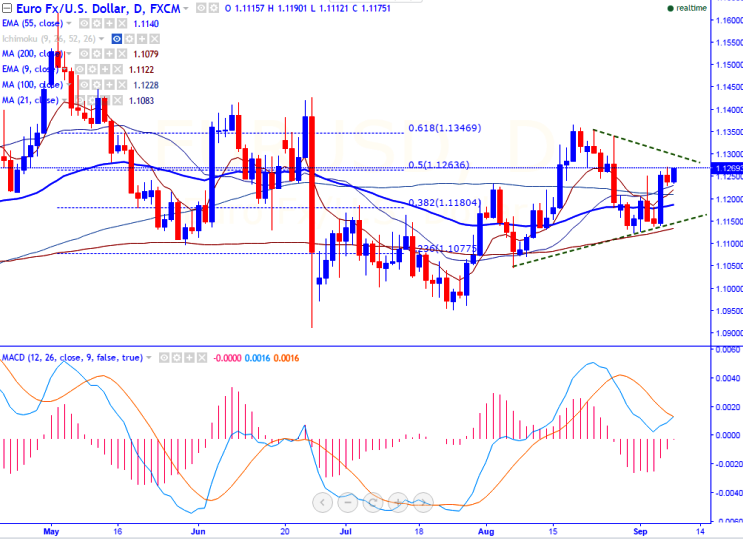

- Major resistance- 1.12630 (50% retracement of 1.16163 and 1.09115).

- Major support – 1.1209 (100- day MA).

- EUR/USD has broken major resistance at 1.12630 and jumped till 1.12714 yesterday. It is currently trading around 1.12640.

- Markets are in a consolidation phase and are awaiting ECB monetary policy for further bullishness.

- ECB is expected to keep the policy rates unchanged .The refinancing rates will be held at 0.00% and the deposit rate at -0.4% .The bond buying program also will be unchanged.

- Any break above 1.12630 will take the pair to next level till 1.1300/1.13660.

- On the lower side, any violation below 1.1200 will drag the pair till 1.11400/1.1120.

- Short term weakness only below 1.1045.

It is good to buy around 1.1260 with SL around 1.1200 for the TP of 1.1300/1.13660