EURJPY Holds Bullish Edge: Can It Break Resistance at 174.65 Amid Euro Weakness?

EURJPY pared some of its gains on weak Euro. It hits an intraday low of 174.33 and is currently trading at approximately 174.485. Intraday outlook remains bullish as long as support 173.78 holds.

Technical Analysis:

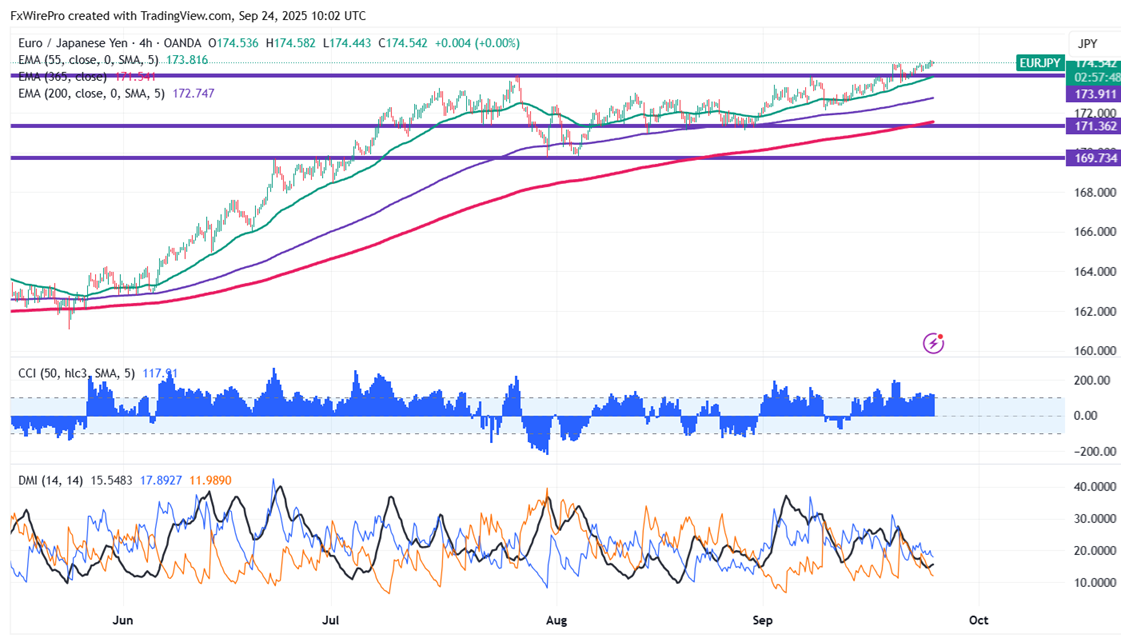

The EUR/JPY pair is trading above the 55 EMA, 200 EMA, and 365-H EMA on the 4-hour chart.

- Near-Term Resistance: Around 174.65, a breakout here could lead to targets at 175/176.

- Immediate Support: At 173.78, if breached, the pair could fall to 173.45/173/172.50-/171.80/170.80/169.70/169/168.70/168.45/168.

Indicator Analysis 4-hour chart): - CCI (50): Bullish

- Average Directional Movement Index: Neutral

Overall, the indicators suggest a mixed trend

Trading Recommendation:

It is good to buy on dips around 173.78-80 with a stop loss at 173 for a TP of 176.