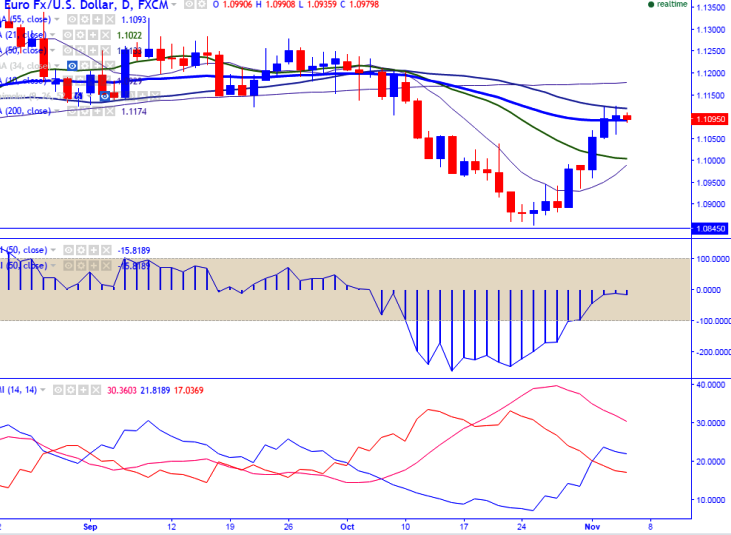

- Major resistance – 1.11260 (50 –day MA)

- Major support – 1.10550 (daily Kijun-Sen)

- EUR/USD declined till 1.10596 yesterday and slightly recovered from that level. It is currently trading around 1.10977.

- The pair’s upside capped by 50 –day SMA and any further bullishness above that level. Any violation above 50- day SMA will take the pair till 1.1177 (200 – day MA)/1.1200.

- On the lower side, any break below 1.1055 will drag the pair down till 1.100/1.0965 (10-day MA).

It is good to buy above 1.11250 with SL around 1.1050 for the TP of 1.120/1.1250.

Resistance

R1-1.11260

R2-1.1180

R3-1.1200

Support

S1-1.1055

S2-1.1000

S3- 1.0965