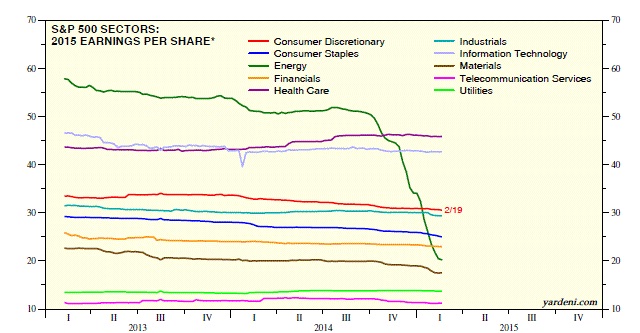

Investors are preparing for lower earnings from US companies, which might result in further moving of funds from US to Europe where record easing by European Central Bank and lower Euro are expected to boost revenue across sectors. Chart courtesy Ed Yardeni.

Two factors affecting the earning calls -

- Lower energy prices - Lower energy prices are not only to affect the earnings of companies operating in that segment but also reduces the lower energy price advantage of US companies.

- Strong Dollar - Stronger dollar is expected to reduce attractiveness of US products that are to face tougher competition from companies in Europe, China and Japan. Higher US dollar also reduces revenue earned outside US.

Sectorial performance -

- Most hurt sector is energy which saw highest EPS throughout 2013 and most parts of 2014.

- Earnings are expected to be further down for consumer discretionary and staples as well as for industrials.

- Lower commodity prices are expected to put pressure over the earnings for companies operating in basic materials segment.

- Two sectors are expected to perform well are healthcare thanks to Obamacare and Information technology as new waves on innovations are boosting performance of the companies in these segments.

Performance of US stocks will be more divergent as some segments are to benefit more from overall rise in economic activities while others suffer from adverse conditions.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary