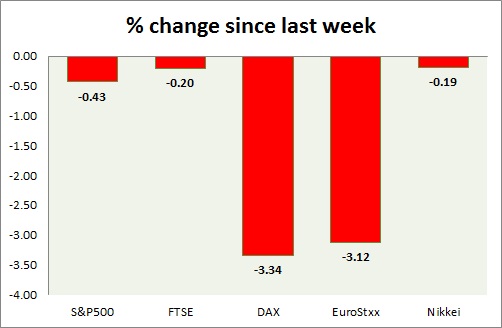

Equities are all mixed in today's trading. Kindly note all instruments mentioned here are CFDs, whose values might differ from cash or future traded. Performance this week at a glance in chart & table -

S&P 500 -

- S&P 500 is marginally down as investors shun equities over ECB disappointment. Today's range 2096-2073.

- S&P 500 future is currently trading at 2081. Immediate resistance lies at 2065, 2120 and support 2000, 1970.

FTSE -

- FTSE is down over global selloffs triggering from Draghi disappointment. Today's range 6445-6335.

- FTSE is currently trading at 6360. Immediate support lies at 5800, and resistance 6500, 6820.

DAX -

- DAX is sharply down, as ECB disappoints to downside. Today's range 10720-11330.

- DAX is currently trading at 10920. Immediate support lies at, 10,500, 9850 area and resistance at 11500 around.

EuroStxx50 -

- Stocks across Europe are red today.

- German DAX is down (-1.9%), France's CAC40 is down (-1.4%), Italy's FTSE MIB is down (-1.3%), Spain's IBEX is down (-1.2%).

- EuroStxx50 is currently trading at 3380, down by -01.5% today. Support lies at 3200 and resistance at 3550.

Nikkei -

- Nikkei is almost flat, trapped between weaker Yen and global selloffs. Today's range - 19770-19970.

- Nikkei is currently trading at 19820. Key resistance around 20100, 20500, while support is at 19500, 19000.

|

S&P500 |

-0.43% |

|

FTSE |

-0.20% |

|

DAX |

-3.34% |

|

EuroStxx50 |

-3.12% |

|

Nikkei |

-0.19% |

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX