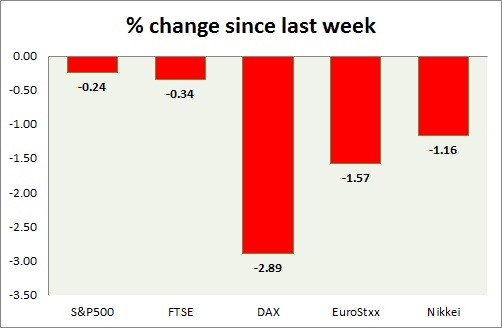

Equities continue to enjoy dovish FOMC and gained grounds in today's trading. Performance this week at a glance in chart & table -

- S&P 500 - US benchmark struggling at its all-time high as dollar gained some of its strength back in today's trading. CPI by 0.2% mom and 0% YoY. Core CPI increased 0.2% mom and 1.7% YoY. Redbook index grew 1.1% mom and 2.8% YoY. New home sales increased by 7.8% to 0.539 million. SPX500 is currently trading at 2106, up 0.15% for the day. Immediate support lies at 2040, 2080 and resistance 2120, 2164.

- FTSE - FTSE gained further above 7000. UK CPI came at 1.2% YoY compared to previous 1.4%. CPI grew 0.3% mom. PPI is down -1.8% YoY. FTSE is currently trading at 7053, up 0.2% today. Support lies at 6700, 6920.

- DAX - DAX gained more than 1% today after Markit PMI showed German economy remained robust and growing. Export orders growing at sharper rate. DAX is currently trading at 12030. Immediate support lies at 11740, 11390 and resistance at 12080, 12250.

- EuroStxx50 - Stocks across Europe are up as PMI presented positive outlook across Euro zone. Germany is up (+1.07%), France's CAC40 is up (+0.9%), Italy's FTSE MIB is up (+1%) and Spain's IBEX is up (+1.33%). EuroStxx50 is currently trading at 3741, up 1.40% today. Support lies at 3635, 3545.

- Nikkei - Nikkei is taking a hit today over profit booking and stronger Yen, however it still might move towards its target of 20,800. Nikkei is trading at 19805. Immediate support lies at 19460, 19220.

|

S&P500 |

-0.09% |

|

FTSE |

0.53% |

|

DAX |

-0.12% |

|

EuroStxx50 |

0.48% |

|

Nikkei |

0.67% |

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary