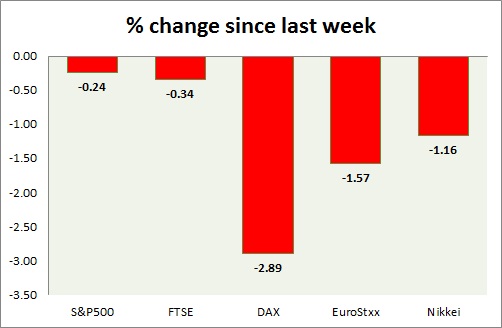

Equities are all in green today, amid risk on environment. Performance this week at a glance in chart & table -

S&P 500 -

- US benchmark has clearly broken above psychological resistance around 2100 area, now might be aiming for new all-time high.

- US presidential race is warming up, Hilary Clinton announced her intention to run.

- Bulls are targeting around 2250 area by next year. Immediate support lies at 1980, 2040 and resistance 2120, 2164.

FTSE -

- FTSE closed above 7000 level last week, trading water around that level for now.

- Uncertainty over election, keeping fresh money at bay, which might jump in once that matter is settled.

- Important support lies at 6700 and resistance around current price towards 7100.

DAX -

- DAX is seeing minor profit booking today, after last week's massive rally to new all-time high. Next target for DAX is coming around 12900.

- Index is trading at 12350, down nearly 0.2% today. Immediate support lies at 12000, 11830, 11750.

EuroStxx50 -

- Stocks across Europe are mixed today. Profit booking is today's theme.

- Germany is down (-0.25%), France's CAC40 is up (+0.20%), Italy's FTSE MIB is up (+0.52%) and Spain's IBEX is up (1.09%).

- Italy's industrial production improved 0.6% m/m in February.

- French current account deteriorated to € -1.8 billion from prior €-0.3 billion.

- EuroStxx50 is currently trading at 3826, up 0.2% today. Broader trend remains upwards. Support lies at 3635, 3545.

Nikkei -

- Nikkei failed to maintain gain above 20000 amid profit booking today. However further gains can't be ruled out.

- Nikkei is currently trading at 19920. Immediate support lies at 19630, 18540 and resistance at 20000, 20800.

|

S&P500 |

+0.10% |

|

FTSE |

-0.34% |

|

DAX |

-0.32% |

|

EuroStxx50 |

+0.16% |

|

Nikkei |

-0.47% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary