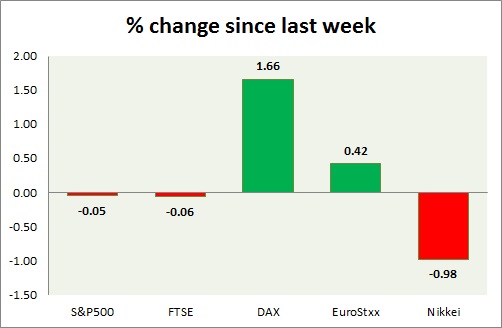

Equities are gaining ground as risk aversion seems to have faded. Performance this week at a glance in chart & table -

S&P 500 -

- S&P gained back lost grounds, as uncertainty over UK election faded as yields drop across world. However bulls are lacking the necessary momentum to push the index to new heights.

- S&P gained higher over today's jobs report.

- April's payroll added about 223,000 jobs, about same as expected, however March and February revised downwards by -39K. Unemployment rate dropped by 0.15 to 5.4%. Average hourly earnings rose 0.2% m/m and 2.2% y/y.

- S&P 500 is currently trading at 2107. Immediate support lies at 1980, 2040 and resistance 2125, 2164.

FTSE -

- FTSE is the best performer today, as risk aversion faded and UK conservative party secured an outright majority in election.

Conservative party has already gained 327 seats in UK's 650 members' parliament, crushing the opponent Labour party to 232. 4 seats remain to be announced. - FTSE might go for a correction over profit booking after election, however stocks are poised to gain over longer term as investments and funds start flowing in UK.

- FTSE is currently trading at 7030, up 2% today erasing this week's loss. Immediate support lies at 6850, 6700 and resistance at 7120.

DAX -

- DAX is trading in green today, due to risk on sentiment.

- Larger trend remains upwards, however bears remain in control in shorter term. Bearish engulfing in weekly chart provided the necessary strength to bears. However bears have weaken by back to back doji and small hammer. Resistance at 11750 remains key.

- Going long makes sense as it remains in line with long term trade.

- German trade balance came at € 19.3 billion for March. Exports rose 1.2%, while imports rose 2.4%.

- Industrial production dropped -0.5% m/m in March.

- DAX is currently trading at 11570. Immediate support lies at 10550 and resistance at 11740, 12080 around. 11000 area might provide psychological support.

EuroStxx50 -

- Stocks across Europe are all trading in green today.

- Germany is up (+0.7%), France's CAC40 is up (+0.8%), Italy's FTSE MIB is up (+1.67%) and Spain's IBEX is up (+1.3%).

- Italy's trade balance rose 0.4% m/m in March and 1.5% y/y.

- Spanish Industrial output up 2.9% y/y in March.

- Risk on environment might push index higher.

- EuroStxx50 is currently trading at 3610. Support lies at 3450, 3300 and resistance at 3760

Nikkei -

- Nikkei gained as yen weakened against dollar as risk aversion faded and bund yield registered sharp drop yesterday.

- Nikkei is currently trading at 19520, further downside is likely should resistance 19750 holds. Price target is coming close to 17800.

- Key support is at 18900, 18400 and resistance at 19750 area.

|

S&P500 |

-0.05% |

|

FTSE |

-0.06% |

|

DAX |

+1.66% |

|

EuroStxx50 |

+0.42% |

|

Nikkei |

-0.98% |

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary