S&P 500 -

- S&P remains best performer this week, trading very close to all time high. Future curved new high today around 2126.

- Empire state manufacturing index came at 3.09 above prior -1.19

- Industrial production dropped by -0.3% m/m in April.

- Preliminary reading of Michigan confidence dropped to 88.6 from 95.9 prior.

- S&P 500 is currently trading at 2122. Immediate support lies at 1980, 2040 and resistance 2125, 2164.

FTSE -

- FTSE gained to 7000 mark, however sellers pushed back from there as pound rose against dollar amid weaker than expected economic activity in US.

- CB leading economic index grew at 0.2% in April compared to 0.6% prior.

- FTSE is currently trading at 6966. Immediate support lies at 6850, 6700 and resistance at 7120.

DAX -

- DAX gained initially taking cue from rising S&P, however rally soon soured as Euro gained against dollar amid weaker than expected data release from US.

- Larger trend remains upwards, however bears remain in control in shorter term. Bearish engulfing in weekly chart provided the necessary strength to bears. Target coming around 10550, should resistance at 11750 holds.

- DAX is currently trading at 11460. Immediate support lies at 10550 and resistance at 11750, 12080 around.

EuroStxx50 -

- Stocks across Europe are trading in red, erasing initial gains.

- Germany is down (-1.2%), France's CAC40 is down (-0.85%), Italy's FTSE MIB is down (+0.1%) and Spain's IBEX is down (-0.75%).

- EuroStxx50 is currently trading at 3572, down -0.75% today. Support lies at 3450, 3300 and resistance at 3760

Nikkei -

- Nikkei is holding on to gains well in spite of massive selloffs in Europe.

- Nikkei is currently trading at 19750, further downside is likely should resistance 19750-19850 holds. Price target is coming close to 17800. However downside is diminishing given bull's resilience.

- Key support is at 18900, 18400 and resistance at 19750 area.

|

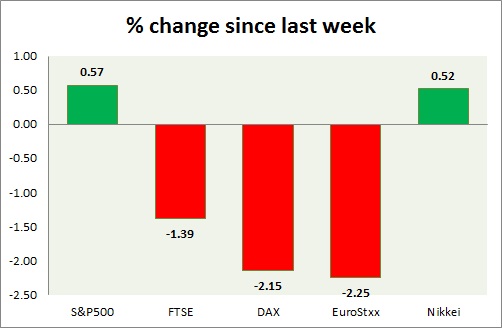

S&P500 |

+0.57% |

|

FTSE |

-1.39% |

|

DAX |

-2.15% |

|

EuroStxx50 |

-2.25% |

|

Nikkei |

+0.52% |

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary