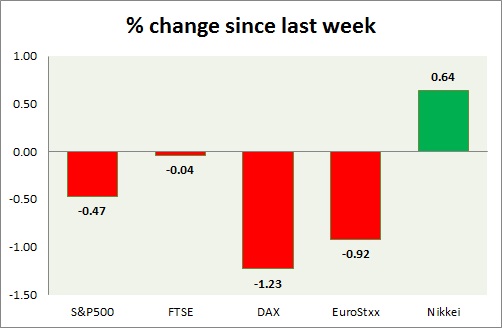

Equities are marginally lower today. Performance this week at a glance in chart & table -

S&P 500 -

- S&P is marginally down today, over profit bookings.

- Initial jobless claims rose to 282K.

- Pending home sales grew by 3.4%m/m in April and 14% from a year ago.

- S&P 500 is currently trading at 2117. Immediate support lies at 1980, 2040, 2080 and resistance 2164.

FTSE -

- FTSE is treading water today after crossing 7000 mark yesterday. Today's range 7049-7005.

- Second preliminary estimate showed UK GDP grew 0.3% in first quarter and 2.4% from a year ago.

- FTSE is currently trading at 7029. Immediate support lies at 6850, 6700 and resistance at 7120.

DAX -

- DAX is trading in small range of 11690-11780 today. German import price index rose 0.6% m/m in April, however still down by -0.6% from a year ago.

- Larger buy trend have resumed. Upside target is coming at 12600-12700 with stop at 11100.

- DAX is currently trading at 11693. Immediate support lies at 11250 and resistance at 12080 around.

EuroStxx50 -

- Stocks across Europe are all trading in red today.

- Germany is down (-0.68%), France's CAC40 is down (-0.91%), Italy's FTSE MIB is down (-0.43%) and Spain's IBEX is down (-0.66%).

- EuroStxx50 is currently trading at 3646, down 1% today. Support lies at 3450, 3300 and resistance at 3760.

Nikkei -

- Weaker Yen is providing the necessary support. Expect heavy profit bookings near 21000 area. Nikkei is the best performer this week so far.

- Nikkei is currently trading at 20488. Key support is at 20200, 19500 and resistance at 20900 area.

|

S&P500 |

-0.47% |

|

FTSE |

-0.04% |

|

DAX |

-1.23% |

|

EuroStxx50 |

-0.92% |

|

Nikkei |

+0.64% |

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings