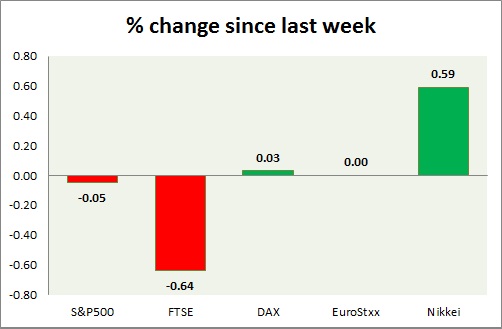

Equities are mixed across globe today. Performance this week at a glance in chart & table -

S&P 500 -

- S&P is down as dollar's rise and yields move higher.

- PCE income grew by 0.4% m/m in April, while expenditure remained flat. Core inflation was weaker than expected at 0.1% m/m

- Market manufacturing PMI came at 54 in May, while ISM manufacturing improved to 52.8 in April.

- Construction spending grew by 2.2% m/m in April.

- S&P 500 is currently trading at 2109. Immediate support lies at 1980, 2040, 2080 and resistance 2164.

FTSE -

- FTSE broken below 7000 mark as PMI revealed slowdown in economy. Today's range 7049-6937.

- FTSE is currently trading at 6944. Immediate support lies at 6850, 6700 and resistance at 7120.

DAX -

- DAX is suffering amid risk aversion. Today's range11509-11347. German PMI came weaker than expected at 51.1 in May.

- Larger buy trend remains in place. Upside target is coming at 12600-12700 with stop at 11100.

- DAX is currently trading at 11460. Immediate support lies at 11250 and resistance at 12080 around.

EuroStxx50 -

- Stocks across Europe are all mixed today. Bears are still retaining control.

- Germany is up (+0.03%), France's CAC40 is up (+0.46%), Italy's FTSE MIB is down (-0.04%) and Spain's IBEX is up (+0.18%).

- EuroStxx50 is currently trading at 3578, up 0.06% today. Support lies at 3450, 3300 and resistance at 3760.

Nikkei -

- Weaker Yen is providing the necessary support to Nikkei, which is likely to move higher.

- Japanese manufacturing PMI came flat at 50.9 for May.

- Nikkei is currently trading at 20565. Key support is at 20200, 19500 and resistance at 20900 area.

|

S&P500 |

-0.05% |

|

FTSE |

-0.64% |

|

DAX |

+0.03% |

|

EuroStxx50 |

+0.06% |

|

Nikkei |

+0.59% |

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary