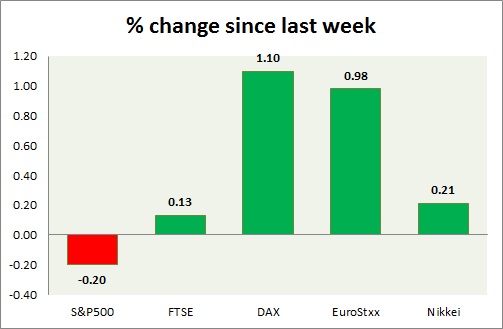

Equities remained the top performing asset class in recent time & performing well this week so far but remain mixed across region. Performance this week at a glance in chart & table -

- S&P 500 - US stock markets are sailing into new highs but trailing the other major markets due to a rate divergence outlook. It has so far failed to take definite queues either from comments of chair Yellen or stronger data coming out of US. It is currently trading at 2113, flat for the day. Immediate support lies at 2084.

- FTSE - FTSE remains the worst performer of the week and might only see momentum if it breaks above 7000. It is still treading water at its all-time high of 6930. FTSE is currently trading at 6929. Support lies at 6870.

- DAX - DAX again moved to new highs benefiting from the portfolio flow and gaining from the safe haven status of Germany. Better employment and confidence figure was published today. It's breaking into new all-time high, currently trading at 11284, immediate support lies at 11160.

- EuroStxx50 - Finally today in the week, stock market across Europe started to perform well on the back of rising confidence among investors. Today EuroStxx 50 is better performer than DAX, due to risk on sentiment across the continent. EuroStxx50 is currently trading at 3570, up 0.85% for the day. Support lies at 3485.

- Nikkei - Nikkei is today's top performer among the indices here and continues to diverge from the performance of Yen. Data on CPI, retail sales & industrial production to be released later today will be main focus. Nikkei is trading at 18836. Immediate support lies at 18500.

|

S&P500 |

0.14% |

|

FTSE |

-0.27% |

|

DAX |

1.41% |

|

EuroStxx |

1.25% |

|

Nikkei |

1.73% |

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings