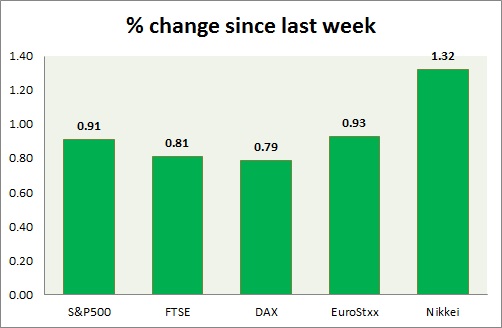

Equities are all trading in green today as risk aversion subsided further and Greece moves closer to a deal. Performance this week at a glance in chart & table -

S&P 500 -

- S&P likely to move into new high as Greek crisis comes closer to end and US is more or less immune to Greece other than general risk aversion.

- 2040 area, once again proved crucial last week.

- S&P 500 is currently trading at 2096. Immediate support lies at 1980, 2040 and resistance 2100.

FTSE -

- FTSE is riding the optimism and likely to move higher, however stronger pound might provide some headwinds. Banking sector helps to push into green. Today's range 6630-6770.

- 6750 area, proving to be crucial resistance.

- FTSE is currently trading at 6730. Immediate support lies at, 6050 and resistance at 7000.

DAX -

- DAX seems to be happy with the deal, forwarded by German led creditors to Greece.

- German government is likely to vote on negotiation on Friday.

- DAX is currently trading at 11480. Immediate support lies at, 10500 and resistance at 11500, 12100 around.

EuroStxx50 -

- Stocks across Europe are all trading in green as market is more confident over Greece staying in Euro zone.

- Germany is up (+1.5%), France's CAC40 is up (+2%), Italy's FTSE MIB is up (1%), Portugal's PSI 20 is up (+1.65%), Spain's IBEX is up (+1.5%)

- EuroStxx50 is currently trading at 3587, down by +0.9% today. Support lies at 3300 and resistance at 3760.

Nikkei -

- Nikkei is likely to move higher on global optimism over Greek deal and as yen is likely drop further.

- Nikkei is currently trading at 20340. Key support is at 19500 and resistance at 20500 area.

|

S&P500 |

+0.91% |

|

FTSE |

+0.81% |

|

DAX |

+0.79% |

|

EuroStxx50 |

+0.93% |

|

Nikkei |

+1.32% |

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?