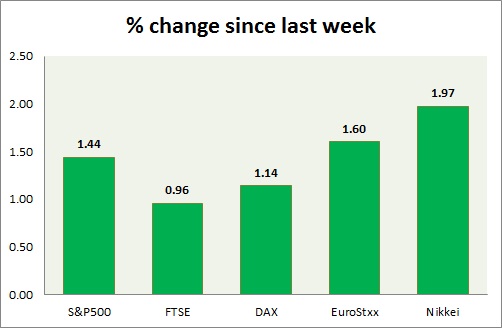

Equities are all mixed today. Performance this week at a glance in chart & table -

S&P 500 -

- S&P once again broke above 2100 area, after taking support around 2040 once again.

- S&P might move to new all-time high over coming days, however move is likely to be in consolidation phased manner.

- S&P 500 is currently trading at 2107. Immediate support lies at 1980, 2040 and resistance 2100.

FTSE -

- FTSE is trading in green today, in spite of BOE governor indicating rate hike ahead. Today's range 6710-6750.

- 6750 area, proving to be crucial resistance.

- FTSE is currently trading at 6750. Immediate support lies at, 6050 and resistance at 7000.

DAX -

- DAX is marginally up today, as Greek optimism still fuelling the trade.

- However, optimism over Greek deal is fading somewhat.

- DAX is currently trading at 11520. Immediate support lies at, 10500 and resistance at 11590, 12100 around.

EuroStxx50 -

- Stocks across Europe are all trading in mixed, but optimism looks to be fading.

- Germany is up (+0.28%), France's CAC40 is up (+0.69%), Italy's FTSE MIB is down (-0.17%), Portugal's PSI 20 is up (-0.62%), Spain's IBEX is up (+0.15%)

- EuroStxx50 is currently trading at 3611, up by +0.5% today. Support lies at 3300 and resistance at 3760.

Nikkei -

- Nikkei is likely to move higher on global optimism over Greek deal and as yen is likely to drop further.

- With Greece away from the radar focus now turns on BOJ's loose monetary policy.

- Nikkei is currently trading at 20480. Key support is at 19500 and resistance at 20500 area.

|

S&P500 |

+1.44% |

|

FTSE |

+0.96% |

|

DAX |

+1.14% |

|

EuroStxx50 |

+1.60% |

|

Nikkei |

+1.97% |

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary