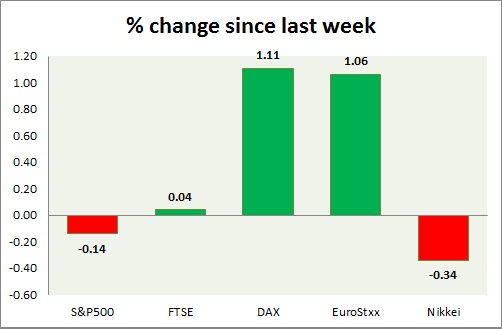

Equities are mixed across globe today. Performance this week at a glance in chart & table -

S&P 500 -

- S&P is marginally down today. Today's range 2109-2096.

- US personal income rose 0.4% in June. Personal spending rose by 0.2%.

- PCE price index rose by 0.3% y/y in June, with core rising 1.3%.

- ISM manufacturing slowed to 52.7 in July, while manufacturing PMI remained same at 53.8.

- S&P 500 is currently trading at 2103. Immediate support lies at 1980, 2040 and resistance 2150.

FTSE -

- FTSE lower today, led by profit booking. Today's range 6710-6670.

- FTSE is currently trading at 6690. Immediate support lies at, 6050, 6450 and resistance at 6850, 7000.

DAX -

- DAX is higher today as investors poured in money into European stocks, led by growing optimism. Today's range 11460-11250.

- DAX is currently trading at 11440. Immediate support lies at, 10500-10600 area and resistance at 11800 around.

EuroStxx50 -

- Stocks across Europe are up today.

- Germany is up (+1.1%), France's CAC40 is up (+0.70%), Italy's FTSE MIB is up (+0.60%), Portugal's PSI 20 is down (-0.60%), Spain's IBEX is up (+0.20%)

- EuroStxx50 is currently trading at 3605, up by +0.45% today. Support lies at 3300 and resistance at 3760.

Nikkei -

- Nikkei headed higher over investors' optimism on quantitative easing.

- Japan manufacturing PMI slowed to 51.2 from 51.4

- Nikkei is currently trading at 20530, with support around 20000 and resistance at 21000.

|

S&P500 |

-0.14% |

|

FTSE |

+0.04% |

|

DAX |

+1.11% |

|

EuroStxx50 |

+1.06% |

|

Nikkei |

-0.34% |

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate