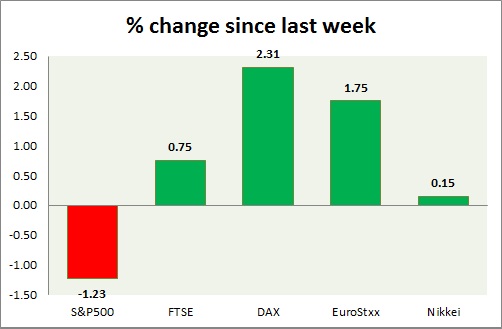

Equities are down globally ahead of FOMC. Performance this week at a glance in chart & table -

S&P 500 -

- S&P losing ground over massive profit booking heading into tomorrow's NFP report. Today's range 2104-2075.

- Initial jobless claims came at 270,000, higher than prior 267,000.

- US stocks are biggest loser this week.

- S&P 500 is currently trading at 2081. Immediate support lies at 1980, 2040 and resistance 2150.

FTSE -

- FTSE is marginally down as BOE minutes provided support, which was erased by global selloffs. Today's range 6760-6710.

- While 8 members voted in favor of current policy hold, 1 voted in favor of rate hike.

- FTSE is currently trading at 6740. Immediate support lies at, 6050, 6450 and resistance at 6850, 7000.

DAX -

- DAX is down marginally over profit booking. Today's range 11530-11670.

- DAX is currently trading at 11570. Immediate support lies at, 10500-10600 area and resistance at 11800 around.

EuroStxx50 -

- Stocks across Europe are mixed today.

- Germany is down (-0.45%), France's CAC40 is down (-0.06%), Italy's FTSE MIB is down (-0.60%), Portugal's PSI 20 is down (-2.24%), Spain's IBEX is down (-0.26%)

- EuroStxx50 is currently trading at 3660, down by -0.14% today. Support lies at 3300 and resistance at 3760.

Nikkei -

- Nikkei is down too over profit booking. Weaker Yen might boost bulls further.

- Nikkei is currently trading at 20630, with support around 20000 and resistance at 21000.

|

S&P500 |

-1.23% |

|

FTSE |

+0.75% |

|

DAX |

+2.31% |

|

EuroStxx50 |

+1.75% |

|

Nikkei |

+0.15% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings