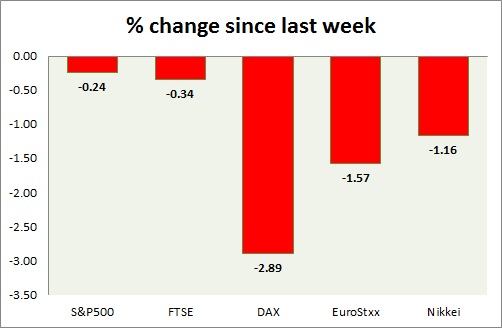

Equities performances are mixed today as some gave up yesterday's gain while others continued. Performance this week at a glance in chart & table -

- S&P 500 - US benchmark dipped into losses and further diverged from their European counterparts today after solid job report showed job gains of 295,000. S&P 500 is currently trading at 2091. Immediate support lies at 2084 and 2040.

- FTSE - FTSE continued its struggle to break above the 7000 level but failed to break above the interim resistance. It's currently trading at 6922, down near 0.50% for the day. Support lies at 6870 and resistance near 6965.

- DAX - DAX, star performer of the week, continues to rise despite fall in other major indices across globe. Yesterday's comments from Mario Draghi continue to support the rise. Today's positive German industrial production at +0.6% mom is adding up to the cheer. DAX is currently trading at 11540. Immediate support lies at 11180.

- EuroStxx50 - Stock performance is mixed across Europe. Germany is up (0.40%), France is flat, and Italy is up by 0.40% whereas Spain is down by 0.20%. EuroStxx is currently trading at 3626, up 0.30% for the day. Support lies at 3540.

- Nikkei - Nikkei once again seems to be taking queue from the easy central bank monetary policy and weakening Yen. The pair is trading at the psychological level of 19000. The price pattern suggests Nikkei could be targeting as high as 20820. Immediate support lies at 18500.

|

S&P500 |

-0.73% |

|

FTSE |

-0.37% |

|

DAX |

1.41% |

|

EuroStxx |

0.98% |

|

Nikkei |

0.74% |

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary