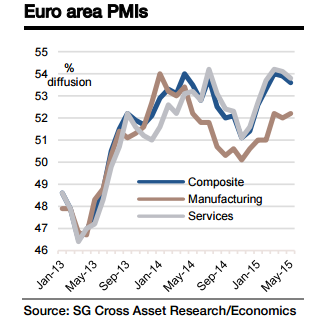

In the past months, the Euro area's service sector has been supported by household consumption, whereas corporate spending and export growth, which are more significant for the manufacturing sector, have taken longer to respond to the positives of a lower oil price and weaker euro. These drivers might change slightly in Q3 as consumption begins to ease.

For June, further growth in both the manufacturing and services sectors is expected. "The manufacturing PMI to increase from 52.2 in May to 52.5 and the services PMI should increase from 53.8 to 54.1", says Socgen.

The composite PMI has softened for three consecutive months. In particular, the rates of expansion in output and new orders slowed to a threemonth low. On the whole, the euro area is supported by QE, low oil prices (compared to one year ago), easing credit conditions and a more neutral fiscal stance.

Historically, our June forecast PMI levels (for both the manufacturing and service sectors) have been consistent with GDP growth of close to 0.4%. Thus our PMI forecasts, if realised, imply 0.4% Q2 15 growth for the euro area - our current growth forecast.

"Looking at the regional breakdown, the German manufacturing PMI is expected to bounce from 51.1 to 51.5, and the services sector PMI to increase from 53.0 to 53.4. For the French manufacturing PMI, a slight increase from 49.4 to 50.0 is forecasted, which would reflect a catching up from surprisingly low levels and an easing of the contraction of the manufacturing sector. The services PMI is to increase from 52.8 to 52.9, mirroring recent improvements observed in the Bank of France survey", added Socgen.

Euro Area's June PMIs to suggest stable second-quarter growth of 0.4% qoq

Monday, June 22, 2015 7:37 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX