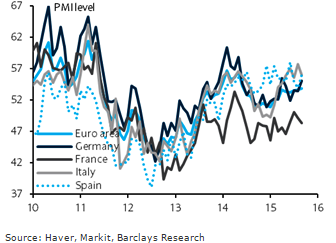

The euro area final manufacturing PMI headline was revised down slightly to 52.3 (-0.1 points), mainly due to the employment index. Nonetheless, business confidence in August was broadly unchanged from July, continuing to show remarkable resilience since March 2015. However, an early divergence is seen from the EC survey, which dropped 0.8 points in August.

German PMIs have been revised up 1 tenth to 53.3, confirming the "flash" uptick, while the drop in France was eventually larger (revised down 0.3 points to 48.3). In Germany, upside revisions in output and new orders to 55.1 and 54.3, the highest levels since spring 2014, more than offset a downward revision in employment.

"Over the month, German PMIs made a remarkable gain in a challenging international environment, notably related to China. The 3.4 points gain in export new orders to 52.8 was confirmed. It will be crucial to monitor whether Germany can sustain these levels of confidence. Meanwhile, output and new orders in France led the headline downward revision, while the INSEE surveys painted a more positive picture", says Barclays.

Drops in other countries showed an overall more negative sentiment versus the early release. Italy experienced a noticeable fall (-1.5 points to 53.8), while Spain edged down 0.4 points to 53.2. The headline index for Ireland plunged 3.2 points to 53.6, its lowest level since February 2014.

"The indices in Austria and the Netherlands also fell c.2 points. After a 16.7-point plunge to a record low of 30.2 in July, the headline index for Greece improved to 39.1. Falls in the EC survey's industrial confidence readings for Germany and Italy suggest that the relative resilience in euro area PMIs should be viewed with some caution. While PMIs remain at elevated levels, suggesting ongoing decent momentum for Q3, some downside may be in the pipeline for Q4", added Barclays.

Euro area August final manufacturing PMIs confirms resilience

Wednesday, September 2, 2015 7:50 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed