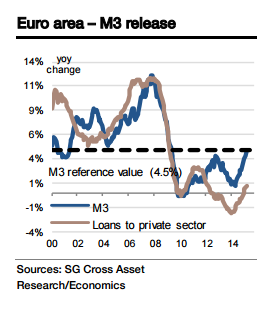

Continued improvements have been seen in monetary and credit dynamics since the ECB adopted an accommodating stance back in June (rate cuts, TLTRO, QE).

Indeed, M3 money supply growth recovered from a lacklustre 1.1% yoy in May 2014, to 2.0% in August, then to 4.6% in March 2015.

"We expect this improvement to have continued in April - bolstered by the new QE programme - with the closely followed metric probably having risen 4.9% yoy during that period (bringing the 3-month average to 4.5%)", says Societe Generale.

The flow of credit to the private sector should continue to depict a strong credit impulse. Short term, this is seen supporting higher asset prices rather than higher real GDP growth.

The rebound in housing starts and capex remains indeed modest. Medium term, there is a good chance that the improvement in the outlook will give companies sufficient confidence to start investing and hiring again (the same should hold true for household consumption), although at a modest pace.

Euro area - Further improvements in monetary and credit dynamics in April

Tuesday, May 26, 2015 12:53 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX