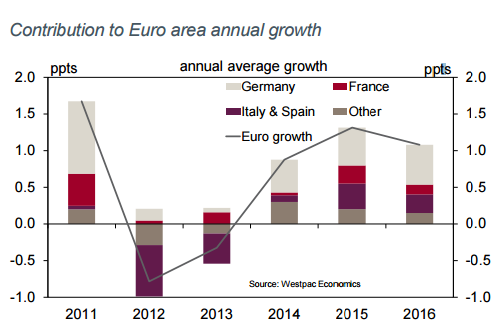

Despite continued anxiety surrounding Greece, 2015 has been a positive year for the Euro Area in aggregate. This has in large part been due to the liquidity and confidence effects of the ECB's well-telegraphed, long-term alternative easing program. Broadly, while these policy actions are yet to stoke a desire for greater capacity amongst businesses, households have responded with great enthusiasm. Consumer spending has firmed noticeably, as has credit growth.

"We anticipate another healthy gain for GDP in Q2 of 0.4%, in line with the Q1 result. That will see annual growth firm to 1.3%yr," notes Westpac Research.

The cross-country growth breakdown is likely to remain mixed, with: particularly strong growth continuing in Spain; robust expansion in Germany; but more modest gains in Italy and France.

Euro area GDP is expected to grow by 0.4% in Q2

Sunday, August 9, 2015 10:39 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX