BofA Merrill Lynch notes:

We have been tactically cautious but structurally bullish on European equity markets largely because a genuine recovery is emerging in the euro area economy. We do not believe the disruption from Greece is likely to alter this.

At just 1.8% of total GDP, Greece is too small a part of the euro area economy on its own to substantially affect overall growth. If the ECB is able to limit any contagion, which we believe it can, then the recovery should remain intact.

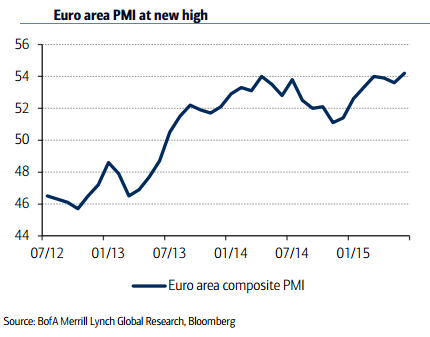

Recent data remain robust, with the composite PMI reaching a new high in June. Consumer confidence has slipped a little from its March highs, but it remains at the highest levels since 2007. Bank lending continues to strengthen, and unemployment has fallen steadily.

While bond yields backing up will concern the ECB, our economists think the central bank will react to drive them down one way or another. The issuance drought over the summer will be an interesting test of whether yields can be pushed lower. If not, then we would expect more statements and/or an acceleration of uantitative easing (QE).

One effect of ECB intervention may be to put the euro under renewed pressure, although we would not want to put too much weight on that given its resilience of late. Our economists have also highlighted that yields are much more important than the currency in determining monetary conditions.

Euro area: Greece aside, it is still improving

Tuesday, July 14, 2015 11:56 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022