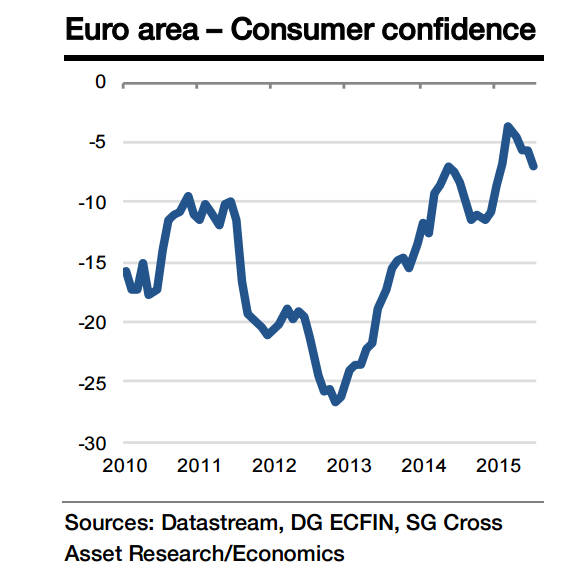

Euro area consumer confidence has been rising dramatically since 2013, reaching historically high levels. Since the beginning of the year, it has improved further on the back of falling oil prices. However, since May, consumer confidence in the euro area has dropped from -3.7 to -7.1 and it is expected to remain unchanged in August on the back of a mixed picture from the real economy.

While concerns over the global outlook is likely to impact consumer confidence negatively, improving labour markets and a further decline in oil prices are likely to counterbalance.

Euro area consumer confidence to remain stable in August

Monday, August 17, 2015 10:05 PM UTC

Editor's Picks

- Market Data

Most Popular

Oil Prices Surge to 2025 High as U.S.-Israel Conflict With Iran Threatens Global Energy Supply

Oil Prices Surge to 2025 High as U.S.-Israel Conflict With Iran Threatens Global Energy Supply  Asian Stocks Slide as Middle East Conflict and Rising Oil Prices Shake Global Markets

Asian Stocks Slide as Middle East Conflict and Rising Oil Prices Shake Global Markets  Asian Stocks Rebound as KOSPI Surges, China Signals Stimulus Amid Global Tensions

Asian Stocks Rebound as KOSPI Surges, China Signals Stimulus Amid Global Tensions  Trump Praises Delcy Rodríguez as Venezuela Oil Exports Resume

Trump Praises Delcy Rodríguez as Venezuela Oil Exports Resume  Gold Prices Rebound in Asia as U.S.–Iran Tensions Support Safe-Haven Demand

Gold Prices Rebound in Asia as U.S.–Iran Tensions Support Safe-Haven Demand  Dollar Rally Pauses as Euro Stabilizes Amid Middle East War Uncertainty

Dollar Rally Pauses as Euro Stabilizes Amid Middle East War Uncertainty  Oil Prices Surge as Strait of Hormuz Disruption and Middle East Conflict Threaten Global Supply

Oil Prices Surge as Strait of Hormuz Disruption and Middle East Conflict Threaten Global Supply  Federal Judge Orders Refund of Trump’s Emergency Tariffs, Potentially Returning Up to $182 Billion

Federal Judge Orders Refund of Trump’s Emergency Tariffs, Potentially Returning Up to $182 Billion  Japan’s Rengo Unions Seek Nearly 6% Wage Increase in 2026 Labor Talks

Japan’s Rengo Unions Seek Nearly 6% Wage Increase in 2026 Labor Talks  Chinese Yuan Edges Higher but Faces Biggest Weekly Drop in Over a Year Amid Strong Dollar

Chinese Yuan Edges Higher but Faces Biggest Weekly Drop in Over a Year Amid Strong Dollar  U.S. Stocks Fall as Middle East Tensions Lift Oil Prices and AI Chip Export Rules Hit Tech Sector

U.S. Stocks Fall as Middle East Tensions Lift Oil Prices and AI Chip Export Rules Hit Tech Sector  Oil Prices Surge Over 3% as Middle East Conflict Raises Supply Fears

Oil Prices Surge Over 3% as Middle East Conflict Raises Supply Fears