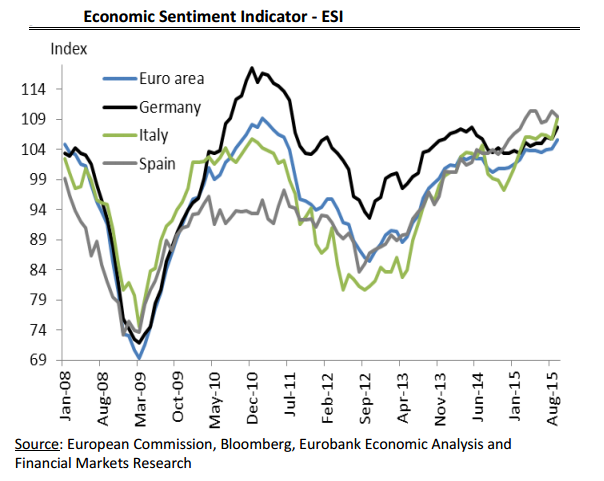

The Economic Sentiment Indicator (ESI) increased in the euro area for the third consecutive month in September, coming in at 105.6 from 104.1 points in the previous month. The improvement in the euro area sentiment was mainly attributed to enhanced confidence in services (+2.3 points) and industry (+1.5 points), which have the highest weight in the composite index (cumulatively accounting for 70% of the total ESI). Additionally, confidence in retail trade improved only marginally (+0.6 points), while construction and consumer confidence marked a slight deceleration on the month (-0.6 and -0.2 points, respectively).

Among the largest euro area countries, the Economic Sentiment Indicator in Italy, Germany and the Netherlands reported the strongest monthly increases (+3.4, +1.9 and +1.2 points, respectively), while Spain's ESI declined by 0.9 points breaking a two-month rising streak.

In Greece, the Economic Sentiment Indicator rose by 7.9 points to 83.1 in September from 75.2 in August, increasing for the first time in six months and snapping a downtrend it had embarked on in December 2014. It is worth recalling that Greece's August ESI (75.2) recorded its lowest level since March 2009, following the surprise announcement of the July 5th referendum, the announcement of the temporary bank holiday and the imposition of capital controls on June 28, 2015 that exacerbated the uncertainty about Greece's euro membership. Having said that, there was a sharp decoupling of Greece's Economic Sentiment Indicator from the level recorded by the respective composite euro area sentiment index in August 2015. The successful conclusion of Greece's programme review and the completion of bank recapitalization before end-2015 are expected to further improve economic sentiment in the following months.

Euro area economic sentiment indicator rises for the 3rd consecutive month in September

Tuesday, September 29, 2015 8:49 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX