In the illiquid August market, CNY devaluation and weaker oil prices have raised disinflationary concerns, favouring bullish moves in rates, which are likely to remain supported in the very near term. In the EGB market, easing supply pressure after next week's auction might help reverse some of the latest cheapening of Spain versus Italy.

Negotiations between the Greek government and creditors have progressed significantly over the past few weeks, increasing the likelihood that the deal on the third bailout could be signed before the 20 August ECB payment. In case of any delay, it seems Greece would be provided with a bridge loan to honour the payment to the ECB. With Greek headlines no longer market-moving (at least for now), the usual August lull has been broken this week by the unexpected PBoC decision to devaluate the yuan and to improve pricing mechanisms, making it more dependent on market forces. CNY Liberalization takes a leap forward, 11 August 2015, such changes could bring about more volatility in the fixing with a potentially weaker trajectory than previously. This would add to ongoing weakness in the oil and commodities markets in lowering the global inflation path, with the potential to affect the monetary policy strategy by the major central banks.

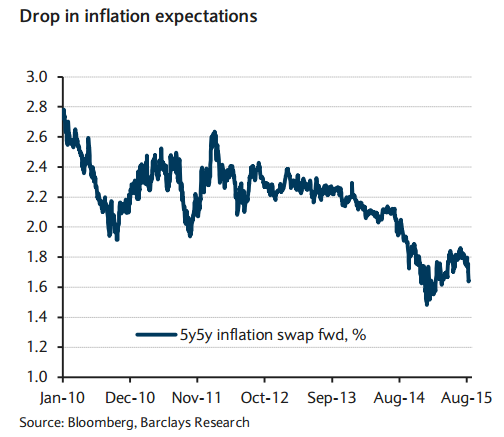

Market reaction to the PBoC's decision has been notable due to increased concerns about its disinflationary effect on economies globally; amid weak commodity and oil prices, it might eventually result in the Fed postponing hikes as well as more measures by the ECB. In this respect, it is interesting to note that the market has started to pull back expectations of a Fed rate hike in September. In the euro money market, the OIS and the Euribor future strips curves have bull flattened, probably because of rising expectations of the ECB's QE programme being extended past September 2016, thus implying a longer-than-expected period of abundant liquidity and an accommodative stance.

Equities have dropped in all markets due to concerns about the negative effects of lower growth in China. Government bonds have gained, with the 10y Bund and Treasury declining about 7bp this week to about 0.63% and 2.18%, respectively. Breakevens have fallen across the board. It is noteworthy that the closely watched 5y5y Euro HICPx swap dropped by about 10bp during the week to 1.67%, which was the lowest close since the end of March 2015.

Euro area rates: Weekly review

Friday, August 14, 2015 12:45 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX