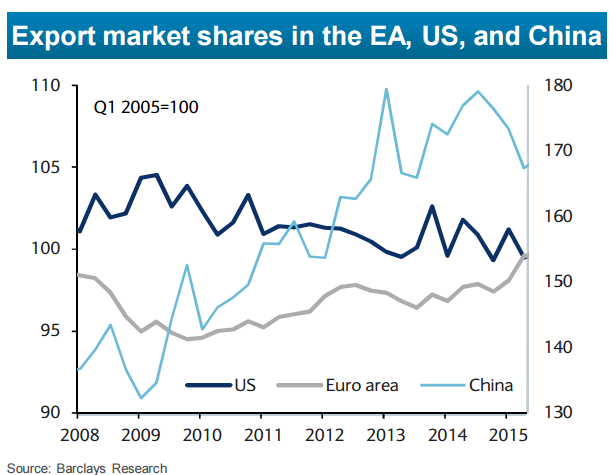

Euro area Q2 GDP growth was in line with the expectations (+0.4% q/q), although stronger exports offset a significant investment contraction and a slowdown in consumption. The strength in exports in H1 15 (5.5% SAAR) was at odds with the weakness of foreign demand (+1.5% SAAR) and probably resulted from the lagged effect of euro depreciation in H2 14 on a real trade-weighted basis, which boosted euro area competitiveness.

Exports are expected to grow more in line with foreign demand from H2 15 and therefore to slow as a result of the weakness of the global economic environment, dragged down by a slowdown in China and other EM countries. Net exports in the euro area is expected to contribute only 0.1pp to annual GDP growth in 2016, versus 0.3pp in the July forecast. August trade data for Germany, just released on 7 October, suggest that this projection is subject to downside risks.

Euro area recovery still on track despite a global slowdown

Tuesday, October 13, 2015 9:29 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed