Euor Area's retail trade, labour market, inflation and consumer confidence data published this week all pointed to ongoing strength in consumer spending. It should continue to be the main driver of growth in Q3, and in subsequent quarters.

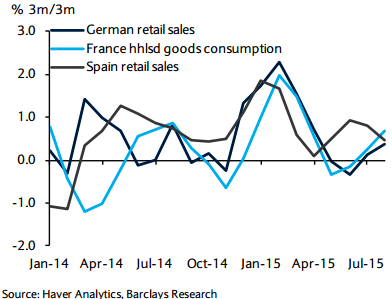

"Hence, although decent euro area growth prospects remain, the recovery is still fragile in the absence of a more stable footing within domestic demand. On a 3m/3m basis, German retail sales and French consumer goods spending accelerated markedly during the summer", states Barclays.

Data through August generated carry-overs of 0.9% and 0.6%, respectively, for Q3, from -0.3% q/q and -0.1% q/q in Q2. These positive developments in the euro area's two largest economies should support an acceleration of private consumption at the euro area level in Q3, while momentum remained elevated in Spain.

This goes hand in hand with ongoing labour market normalisation. The number of unemployed in the euro area inched down by just 1k in August from July, but by a moreconvincing 54k on a 3m/3m basis. At 11.0% for a second month in a row, the unemployment rate continues its downward trend since peaking at 12.1% in spring 2013.

Furthermore, the very low consumer price inflation environment continues to fuel consumer spending. Euro area September "flash" HICP dropped by 0.2pp, back into negative territory, to -0.1% y/y, driven down by energy.

"High levels of consumer confidence in September, bolstered by the unemployment expectations and future economic situation components, suggest the consumerspending engine is set to continue fuelling GDP growth. Also notable is that the balance of opinion on making major purchases in the next 12 months is at its highest level since January 2008", says Barclays.

Euro area's retail trade poised to be strong in Q3

Monday, October 5, 2015 6:18 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022