Euro Zone sentiment report showed confidence tilted despite additional stimulus from European Central Bank. Moreover the data were collected before recent terror attack on Brussels.

- Economic slowdown and fear among business leaders that monetary policy reaching its limit likely to be major driver behind ebbing optimism.

- However concerns over immediate hard landing in China is less of a concern now.

- The potential British exit from the Union, id what some business leaders likely to be worrying about. Lot of investment projects are on hold.

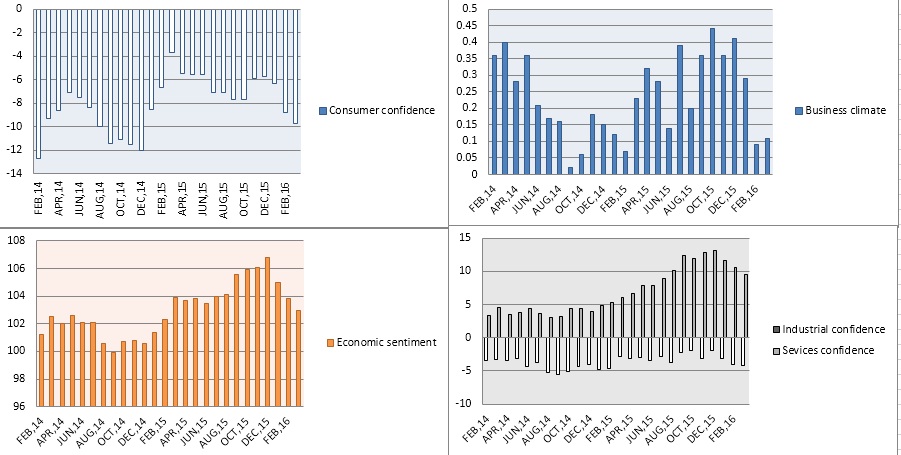

Today’s economic survey showed that sentiment across Euro zone dropped.

- Euro zone business climate is the only indicator that improved but marginally to 0.11. Still around levels last seen back in February last year.

- Industrial confidence dropped to -4.2 lowest since February, 2015. Economic sentiment soured to 103 worst reading since February, 2015.

- Services sentiment dropped drastically to 9.6, lowest reading since July, 2015.

- Consumer confidence dropped to -9.7, worst reading since December, 2014.

All in all trend suggests, that Euro Zone confidence picked in December last year and haven’t really recovered after ECB disappointment and Market turmoil at start of the year.

Euro broadly ignored the release and gaining over weaker Dollar, currently trading at 1.131 against Dollar.

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Australia’s December Trade Surplus Expands but Falls Short of Expectations

Australia’s December Trade Surplus Expands but Falls Short of Expectations  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal