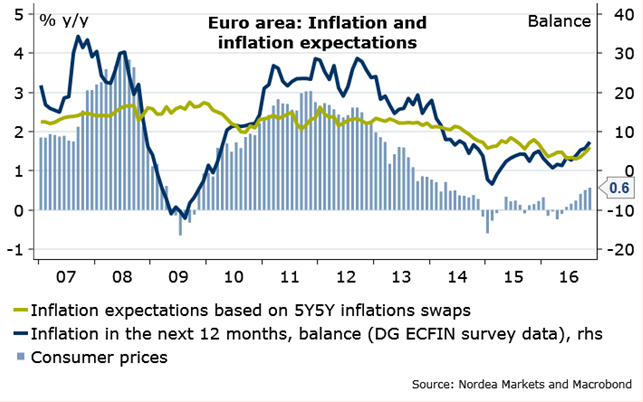

As widely anticipated, euro area’s inflation accelerated marginally in November. The consumer price inflation rose to 0.6 percent year-on-year in November from 0.5 percent in October, in line with consensus expectations. Meanwhile, the core inflation rate, which excludes energy, food, tobacco and alcohol, rose a tad to 0.77 percent from 0.75 percent.

The drag from energy price to inflation rose for the first time since July. This is expected to change in the months ahead as energy prices fell heavily between December 2015 and February 2016. The base effects are expected to accelerate headline inflation to 1.25 percent in the first quarter of 2017, noted Nordea Bank in a research report. This projection can be prevented only by a huge decline in oil prices in the months ahead.

Even if the European Central Bank is not quite focused on current inflation, the low figures very much underpin the case for continued monetary policy support, most possibly a prolongation of the asset purchases to be announced on 8 December. Policy makers are unlikely to conclude that the recent depreciation of the euro would do the trick. Moreover, they cannot consider the rise in market-based inflation expectations as sustainable, according to Nordea Bank.

At 10:00 GMT the FxWirePro's Hourly Strength Index of Euro was neutral at 22.3411, while the FxWirePro's Hourly Strength Index of US Dollar was neutral at -48.3345. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex

Euroarea’s consumer price inflation accelerates slightly in November, core rate remains stable

Wednesday, November 30, 2016 10:56 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed