After European Central Bank disappointed in December and market faced heavy turmoil since New year, sentiment soured across Euro Zone in all segments.

- European Central Bank (ECB) again gave assurance to act in March further and keep policy very accommodative for very long and that might boost sentiment going ahead.

- Concern over immediate hard landing in China and weakness in emerging markets boiling and likely to take toll on sentiment going ahead.

- Business prospect is however great with weaker Euro improving competitiveness of Euro area exports as well as turnaround in domestic economy.

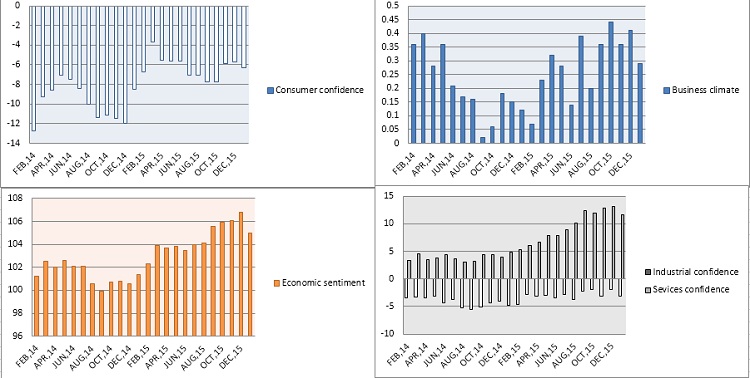

Today's economic survey showed that sentiment across Euro zone dropped sharply.

- Euro zone business climate dropped to 0.29 in January, lowest reading since August, 2015.

- Industrial confidence dropped to -3.2 from -2 prior. Economic sentiment soured to 105 from 106.8, worst reading since August, 2015.

- Services sentiment dropped drastically to 11.6 from 13.1, again lowest reading since August, 2015.

- Consumer confidence dropped to -6.3 from -5.7.

Euro is currently trading at 1.09 against Dollar.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed